Climbing the American wall of worry

- US‑China trade talks’ breakthrough

- “Big beautiful bill” makes the waves in multiple markets

- US credit rating downgrade, debt worries

- Resurfacing trade fears – EU and Apple in the spotlight

Having gone on a truly chaotic ride since the beginning of April, markets have quite successfully recovered from the recent drop, as the news’ flow during May has suggested still chaotic, yet somewhat less dramatic turn of events. For now, many of the new US presidential self‑imposed deadlines on the trade negotiations happen to fall in early July, which to many investors might seem like optimistically long term, with the pace of Donald Trump administration in mind.

In May the developed markets’ equities (measured by MSCI World index in EUR) have jumped 6.06%, while emerging markets’ equities (measured by MSCI Emerging Market index in EUR) have risen 4.40%. During the same period yields on bonds were rising, with 10‑year U.S. Treasury bond yields jumping to 4.42% from 4.18% a month ago, while German 10‑year Treasury bond yields have risen to 2.51% from 2.44% a month ago.

US and China talks

In May, the United States and China reached a significant breakthrough in their ongoing trade negotiations, agreeing to a temporary reduction in reciprocal tariffs from over 100% to just 10% for a 90‑day period. This truce, announced after closed‑door meetings in Geneva, was widely seen as a positive step toward de‑escalating trade tensions that had rattled global markets this year. Financial markets responded with enthusiasm: U.S. stock futures surged, with the Nasdaq, S&P 500, and Dow Jones all posting gains of over 2.5%, reflecting renewed investor confidence. Analysts have assessed the deal as better than expected, sparking a risk‑on sentiment across equities and commodities, globally. Despite all of that, experts cautioned that the 90‑day window might not be enough to resolve deeper structural issues, hence the investors will closely monitor international trade developments in the near future.

Big beautiful bill

The U.S. House of Representatives narrowly passed President Trump's "Big Beautiful Bill" by a 215‑214 vote, marking a major legislative milestone. The bill includes sweeping tax reforms such as eliminating taxes on tips and overtime, expanding child tax credits, and raising the sums to be deducted from the federal tax calculation (SALT). It also introduces stricter work requirements for Medicaid (health program for lower income Americans) and trims federal spending on food assistance. As a result, the bill is criticized as it is set to benefit the well‑off, while being net negative for the lowest income social groups.

In response, Moody’s downgraded the U.S. credit rating from Aaa to Aa1, citing unsustainable debt levels and the fiscal impact of the newly passed “Big Beautiful Bill”. The bill’s sweeping tax cuts, projected to add over $4 trillion to the deficit over the next decade, intensified investor concerns about long‑term fiscal discipline. As a result, bond yields rose, the dollar weakened, and equity markets dipped sharply before partially rebounding.

This story is bound to keep investors engaged, as Congress may still make changes to the legislation. Markets are watching closely for signs of compromise or amendments.

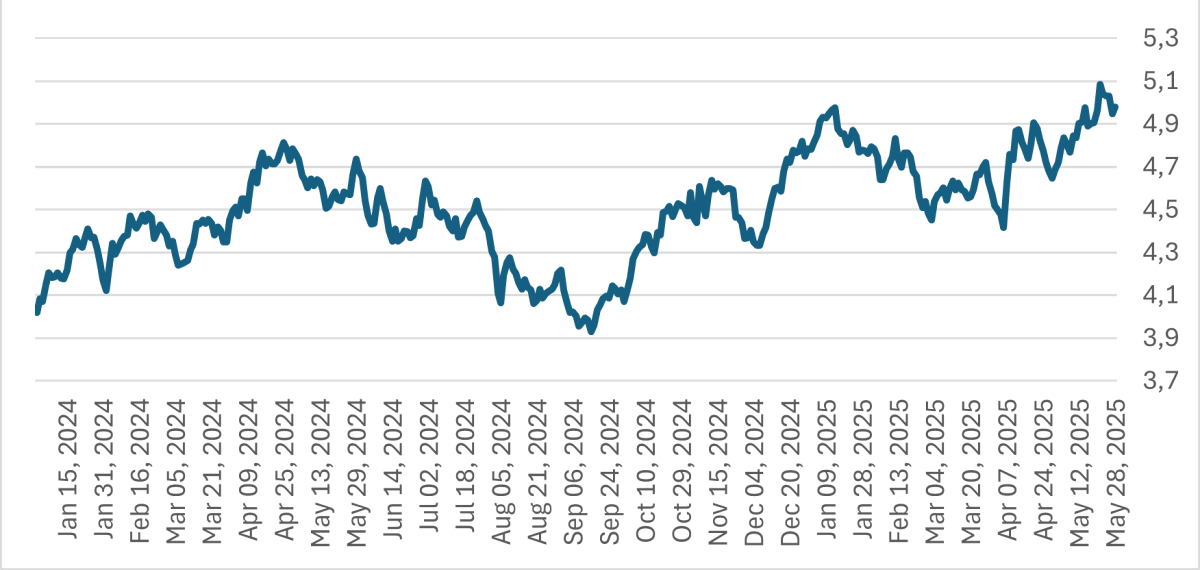

Chart US 30‑year Treasury bond yield, %

Source: Investing.com

Reigniting trade fears

During the month of May global markets were still experiencing the turbulence of U.S. President Donald Trump’s occasional use of trade threats. Late in the month, the targets of the president’s discontent were the European Union and the American company Apple. Mr. Trump has floated the idea of charging the imports of these subjects a 50% and a 25% tariff, respectively, for the alleged lack of progress in trade negotiations with the EU and the alleged unwillingness of Apple to reshore the manufacturing back to the US from Asia.

Apple, which is one of the largest components of the global stock indexes, is heavily reliant on overseas manufacturing, saw its shares drop over 3.5% in the wake of the news. The broader tech sector also took a hit, with investors fearing retaliatory measures from the EU. European markets retreated, with the Eurostoxx 600 falling 2%, while U.S. futures turned negative. Analysts warned that such aggressive tariffs could disrupt supply chains and raise consumer prices.

Market view

The first shock of Donald Trump administration’s ideas to the markets seems to have passed, as the markets have somewhat recovered from the recent lows. It remains to be seen, just how sustainable this recovery proves to be, as most of the ambition in the new US presidential administration is not formally gone, but merely postponed. Should the additional trade barriers and other disruptive ideas remain in the medium term, the US and global economy will have to go through the period of painful adjustment, which may witness the changes in macroeconomic variables which are not necessarily compatible with the full‑fledged bull market optimism.

Warnings

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from the Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, represented within the Republic of Latvia by Luminor Bank AS Latvian branch, reg. No 40203154352, address: Skanstes iela 12, LV-1013, Riga, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Latvian Financial Supervisory Authority (Finanšu un kapitāla tirgus komisija). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Latvia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question, and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument, a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to internal rules on sound ethical conduct, management of inside information, handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.