Economic insights Latvia: autumn 2018 | Luminor

Pēteris Strautiņš, Luminor economist

Latvia outperforms Baltics, but risks of underperformance loom

Pēteris Strautiņš, Luminor economist

Growth forecasts are increased very slightly

This has been a good year for the Latvian economy despite dramatic events in the banking sector and global trade tensions. While our 4.2% forecast issued in March seemed a bit optimistic for a while, it also has become more evident that the economy started the year from a position of strength.

Growth in Latvia has been slightly faster than in the neighbouring countries, as expected.

GDP forecast for 2018 remains almost the same, we upgrade it by 0.1pp to 4.3%. Also the forecast for 2019 is raised by the same step — to 3.8%. Incoming signals point to a continuation of strong growth in the remainder of 2018, may be with a very slight slowdown. The outcome of 2019 will be decided by struggle between favourable internal factors and increasing risks from external environment.

Economy is looking for its limits

While economic growth has matched expectations, employment has exceeded them. The number of people employed grew by 1.9% y/y in H1, the growth rate was only 0.2% in 2017 on average. Unemployment has decreased noticeably faster than expected; our new forecast for the average level in 2018 stands at 7.6% instead of 7.9% in March. Next year it is likely to slip slightly below 7%.

At the same time inflation has been below projections – the new forecast for 2018 is also 0.3 pp below the previous one, at 2.5%. It is especially important that the service price inflation, where excessive wage cost pressures would show up first, has been stable, fluctuating around 3% in annual terms. For the next year we expected overall inflation to accelerate gradually, to slightly below 3%. This rather favourable combination of macro indicators suggests that the potential of the Latvian economy might be slightly larger than thought before, like for its Baltic peers.

Nevertheless, inflation developments present a risk and need to be watched carefully. Wage growth in the first half of the year exceeded 8%, we expect that our 9% growth forecast in 2018 will be attained. The possibility of strong consumption boom is on the cards, adding to labour market pressures and resulting labour cost inflation that is a competitiveness risk.

Exports – slightly bigger, more beautiful

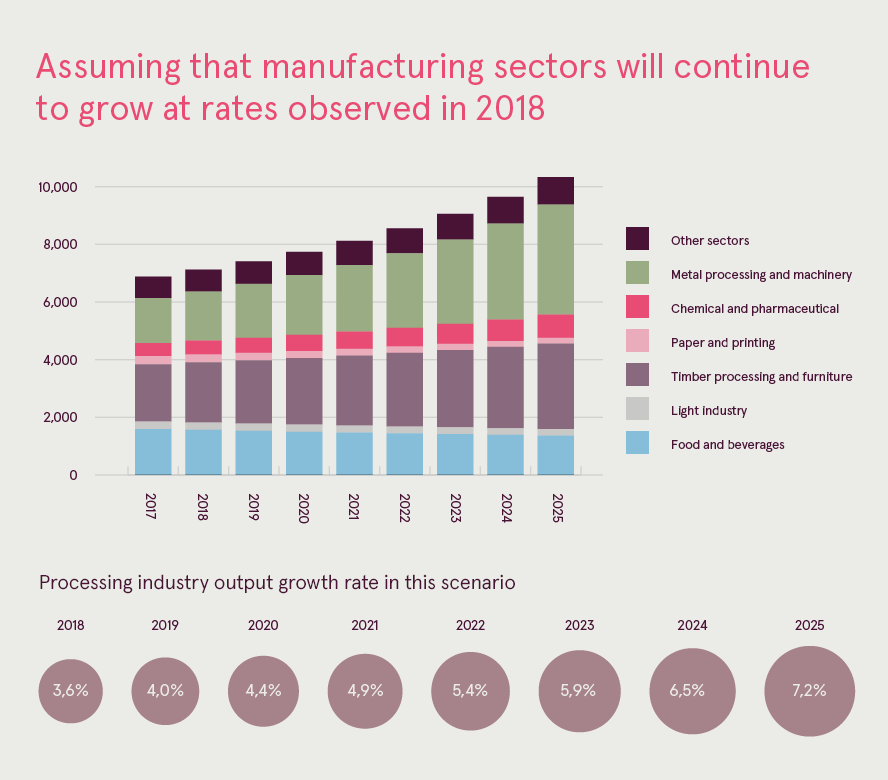

Luminor has been correct to predict that machinery growth will continue to drive manufacturing growth. However, overall performance of manufacturing, the largest export sector has been below expectations, largely because of decline in food processing, which in turn is partly caused by time-out in one milk processing company that looks reversible.

We believe that, despite the fact that this year may be seen as somewhat weak, the growth in manufacturing will be strong in the reporting period (until 2020) and in the years to follow. However, even this year there are sectors that have expanded rapidly. Their share is growing. For example, the total contribution of metal processing, machinery, chemical and pharmaceutical sectors this year exceeds 30%, which is 10 percentage points more than in 2010. These sectors have a higher growth rate potential, are not limited by availability of local raw materials or a market and are competitive in the labour market. The increase of their share will lift the potential growth rate of manufacturing.

Service export performance so far has been mixed in 2018, annual growth sharply slowed down in Q1, but it was the best in Q2 since early 2012. Imports have continued to be slightly faster this year, but the difference has diminished. We are likely to see a similar picture in 2019 as the investment and consumption boom advances.

Believe in future and invest

Investment growth was the main reason why the economy has grown much faster in 2017 and 2018 than in 2016. In 2019 EU fund flows will probably continue to climb, but they will not contribute to the GDP growth rate so much. A lot will depend on the ability of the housing market to take over as the growth driver. There are promising signals. After rising by nearly 10% in Riga and up to 21% in towns in Greater Rīga, housing prices have continued steady, but moderate upward march in 2018. Building permit issuance in H1, 2018 suggests that private sector demand will take over from EU funds as growth driver — the planned volume of not only housing, but also industrial and office construction is growing.

Currently Latvia can be satisfied with its performance. However, there is a risk that in the future growth rate will slip behind that of Baltic peers. It is not yet inevitable.

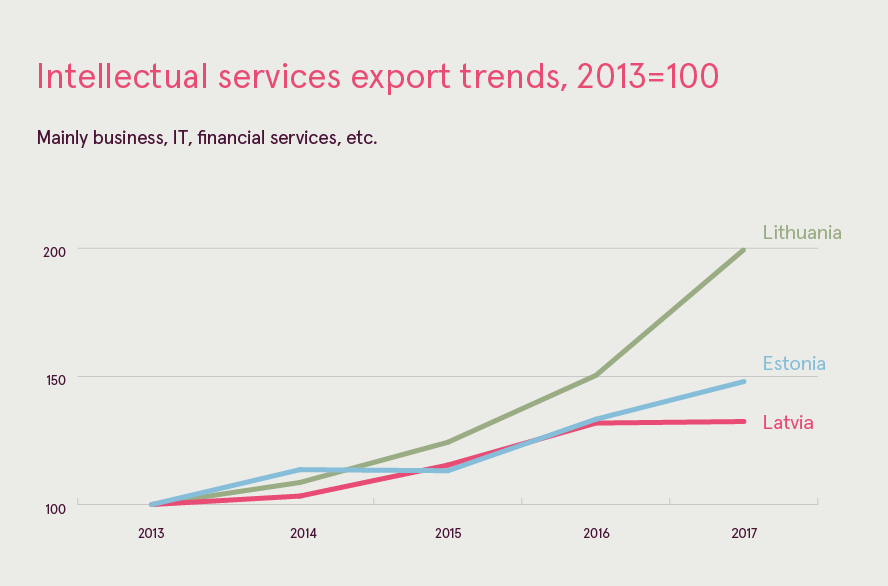

Recently Estonia and Lithuania have recorded truly remarkable “white collar” service export growth, Latvia is advancing, but not quite so fast. On the positive side, there might be larger unused potential in the economy as the unemployment rate is higher, though falling fast. We are on our way to repeat one of the recent success stories of Tallinn and Vilnius — building lots of office space and filling it up with business and IT service exporters. To repeat the recent progress of Lithuania in attracting manufacturing projects, its recipe of co-operation between municipalities and national government as well as government institutions needs to be learned.

Pēteris Strautiņš

Economist

[email protected]

For media contacts: Lita Juberte-Krumina