Economic insights Latvia: spring 2018 | Luminor

Pēteris Strautiņš

Pēteris Strautiņš, Luminor economist

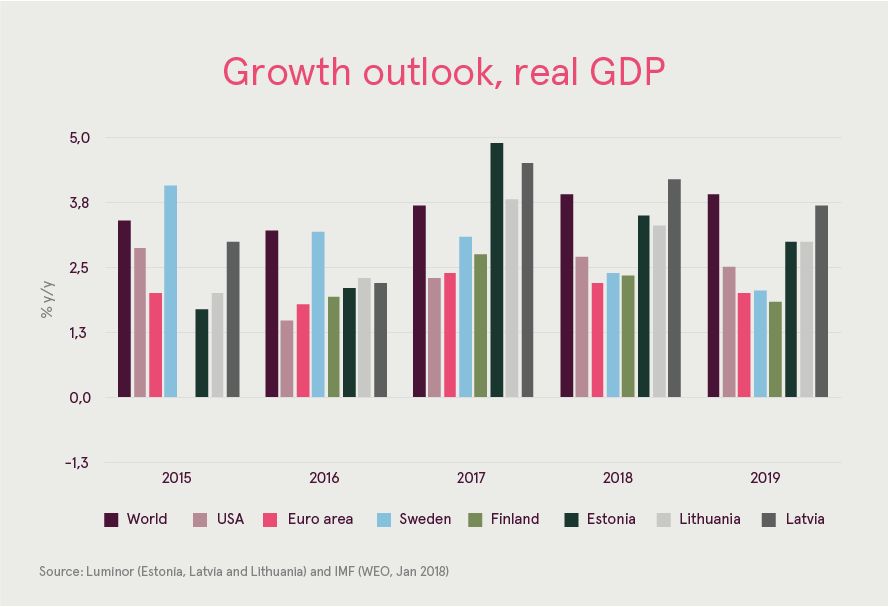

Economic growth in 2017 more than doubled its pace to 4.5 %. Latvia has a chance to grow slightly faster than Estonia and Lithuania in 2018 and 2019 as its economy has more slack — unemployment is higher, inflation is lower and lending recovery is significantly behind. However, taking into account recent events in financial service exports, our GDP growth forecast for 2018 is lowered from 4.5 % to 4.2 %. In the following years the economy is likely to decelerate due to supply side limitations, though this is definitely not the only possible outcome, as we discuss below.

Recent events in financial services have marginally increased downside risks. There are no negative repercussions for banks serving resident households and the real economy of Latvia – companies producing goods and non-financial services. Indirect effects will be limited as the economy is expanding; unemployment is at historic lows in Riga and other businesses are signalling a readiness to hire.

Investment boom will continue

In 2017 exports improvement was marginal, acceleration of consumption growth from 3.4 % to 5.1 % contributed more, but the reversal of the investment trend to a 16.0 % increase from a similar decline a year earlier was the most important factor. The investment boom looks set to continue in 2018. While it is hard to quantify, the range of anecdotal evidence about investment plans in manufacturing is impressive. Industrial enterprises from Northern and Western Europe continue to relocate production lines to existing facilities, news about greenfield projects are relatively rare. After a period of shortage, the supply of high quality office buildings will again start to rise, providing additional opportunities for white-collar service exports. Completions of new office buildings will continue in 2019-2020.

While the impact of EU funds on investment tends to be exaggerated, these flows can influence the timing of investment decisions. The actual flow of EU funds is always difficult to foresee, but experts predict that the peak flows of the current financing period will occur in 2018-2019. On the basis of past experience one can assume that the period is likely to stretch also well into 2020.

Export structure is improving

Export structure is improving

External conditions remain good. Latvia’s exposure to its main export markets is well balanced. Lithuania, Estonia, Russia, Germany + its supplier chains in CEE and the Nordics (as a group) all play fairly similar roles.

Manufacturing, the largest export sector, will continue to grow briskly, though probably just a bit slower than in 2017 (+8.0 %). The share of sectors with the highest potential growth rates — metal processing and machinery, chemicals and pharmaceuticals - is likely to exceed 30 % of output this year, up from 20 % in 2010.

While the success of service exports, apart from transit, is uneven in the main categories (tourism, business, services, IT, finance) over the years, the overall growth rate (around 8 %) has been remarkably persistent since 2010. These “new” service exports — new in the sense that they have grown rapidly from a very low point in 1990s - will be a very important source of growth in coming years. On the other hand, the decline of raw material transit through Latvia has been a persistent risk that started to materialise in the 2nd half of 2017 and the decline seems to be continuing.

While the success of service exports, apart from transit, is uneven in the main categories (tourism, business, services, IT, finance) over the years, the overall growth rate (around 8 %) has been remarkably persistent since 2010. These “new” service exports — new in the sense that they have grown rapidly from a very low point in 1990s - will be a very important source of growth in coming years. On the other hand, the decline of raw material transit through Latvia has been a persistent risk that started to materialise in the 2nd half of 2017 and the decline seems to be continuing.

Not too hot, not too cold, so far

Latvia has by far the lowest inflation in the Baltics. In 2017 prices increased by 2.9 %, but in February 2018 annual inflation declined to 1.8 %. From this point onwards, inflation will pick up and the average for 2018 will be around 2.8 %. Service price inflation has fluctuated around 3 % for several years. There is a substantial risk that it will leave this comfort zone as wage growth picks up from 7.9 % last year to 9.0 % or possibly even more.

Despite the continuous decline in people of working age, the number of people working was almost stable in 2017, but the number of people employed increased by 0.2 %. This can’t last forever, but only time will tell which of these indicators will “give in” – employment will decline again or the population will stabilise or even grow.

Give growth a chance?

Like in all mainstream forecasts, we assume that growth will nevertheless slow in 2019, mostly due to the limited labour supply. The maturity of the US business cycle and arbitrary political decisions about fiscal policy and trade are an obvious risk. However, there is a reasonable chance that growth can remain strong. Economic discourse has been dominated by cautiousness and austerity for years. Far-reaching, perhaps excessive conclusions have been drawn from the episode of slow growth in 2013-2016 that was largely caused by transient events. Effects of weaker demand may sometimes have been interpreted as deep-rooted supply side problems. While there are indeed lots of structural issues, the demand pressures in the following years will be like a good training course that will encourage businesses to change.