Nordea in Baltics earns operating profit of EUR 76 million | Luminor

Nordea in Baltics earns operating profit of EUR 76 million

Nordea Baltic division reported operating profit of EUR 76 million in the first three quarters of 2015. Total income increased by 12% reaching EUR 144 million of which net commission income is amounted to EUR 21 million, increasing by 17% compared to the respective period of year 2014. Total lending volumes remained stable, while the deposit portfolio increased by 5% y-o-y. Nordea continues delivering on Baltic strategy, focusing on building long-term sustainable relationships with its customers.

“Nordea in Baltic countries demonstrated stable growth of revenue, supported by increasing activity of home-bank customers and daily transaction volume growth in private and corporate segments during the first three quarters of 2015. In spite of ultra-low interest rates environment, we maintained a solid advancement of interest income. Commission income also showed a solid growth driven by our continuous focus on relationship banking strategy. Due to increasing market volatility we observe higher demand amongst our customers for risk management solutions, particularly for foreign exchange and interest rate products, and advisory services.”

We see the significance of remote services continuously growing. Latest data shows that number of active mobile netbank users increased by 58% and cards activity by 15% compared to year 2014. Reflecting the ongoing changes in our customers’ behaviour and higher demand for efficient and reliable remote daily banking services, we keep on developing opportunities towards convenient online banking, especially in regard of more efficient customer service,” says Inga Skisaker, Head of Nordea Banking Baltics.

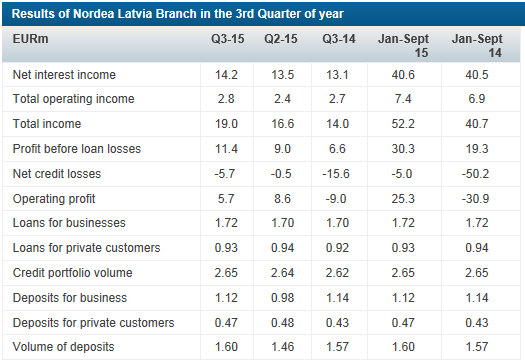

Nordea bank in Latvia reports increasing total income patterns over nine months

Nordea bank in Latvia reported EUR 25.3 million in profits over nine months of the year 2015. Total income increased by 28% compared to the respective period of year 2014 reaching EUR 52.2 million. Net interest income level remained stable; the commission income reached EUR 7.4 million, an increase by 8% year on year.

The total deposit portfolio continues steady growth, reaching a high figure of EUR 1.60 billion supported by volume increase in household deposits (by 10% y-o-y). Deposit portfolio of corporate business showed a slight decrease by 1%, comparing to the same period of year 2014 and gain by 15% in comparison with the previous quarter, 2015. The volumes of total lending have remained relatively stable and amounted to EUR 2.65 billion.

“This quarter we continue demonstrating increasing profit indicators driven by constant focus on strong home-bank relationships with our customers in private and corporate segments. In conditions of relatively weak start of this year and better economic growth rates during the third quarter, also the lending volumes and scale are showing a fair increase. As the segment of small and medium enterprises has become more active, we seek for various support tools and capabilities towards the development of SME’s,” says Janis Buks, the Head of Nordea bank in Latvia. “Due to the currently low interest rates, bank has put efforts into advising our customers on alternative savings and investments products that has resulted in constantly growing sales of such products. Therefore we find especially important to take responsibility on our customers' advisory. To certify bank's intentions towards responsible business practise, Nordea was the one of the first to join the New Self-Regulation Document for the Financial Sector in Latvia”.

Nordea Group's financial results can be found here.

For additional information:

Signe Lonerte, PR Manager, Nordea Latvia,

phone: +371 6 700 5469, mobile phone: +371 29 116 146, [email protected]