Nordea Economic Outlook: in 2016, Latvia's GDP growth will be 3% | Luminor

Nordea Economic Outlook: in 2016, Latvia's GDP growth will be 3%

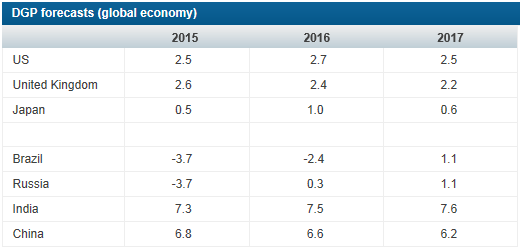

- Global economy: the gap between the West and the East broadens;

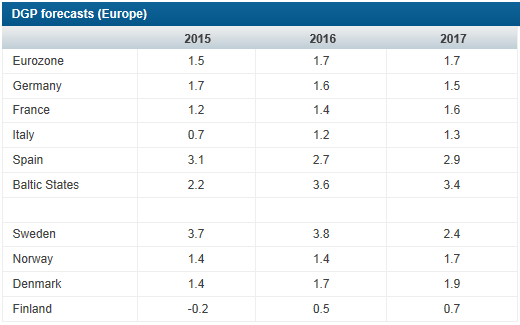

- Baltic economy: stagnating on one hand, and heating up on the other;

- Russia to be blamed for weak export performance;

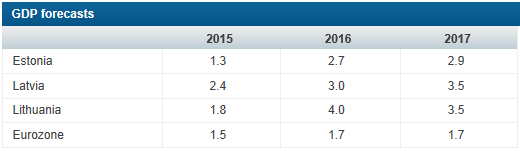

- Latvia shows the fastest growth amongst the Baltic States.

Global economy: the gap between the West and the East broadens

"Global economic growth continues to be dominated by the US and the EU, which both show stable recovery, whereas China, Russia, Brazil and other countries that export commodities are trying to find new drivers for growth. The economic crisis in the emerging markets, mainly China, will be the central global economic risk in 2016. Other risks in emerging economies are also related to low prices for oil and other raw materials forecasted for 2016, and the expected hike of interest rates in the US, which might speed up the outflow of capital from emerging markets. Geopolitical conflicts in Ukraine, the Middle East and Southeast Asia may have a negative effect on the global economy, especially on the European Union, whose “Achilles heel” is the fact that it is strong when united, but weak when divided, " says Chief Economist of Nordea Bank in Lithuania Žygimantas Mauricas.

Baltic economy: stagnating on one hand, and heating up on the other

The phrase “stagnating on one hand, and heating up on the other” is the most accurate description of the current state of the Baltic economy. In the post-crisis period, export growth is weak; however, the domestic economy continues to “overheat”. The main factor affecting domestic consumption, i.e. the rapid growth level of salaries, is currently 5–7 % throughout the Baltic States. In addition, falling unemployment rates, modest inflation and stable consumer purchasing power have enabled domestic consumption to be the main driver of the economy in the Baltics. Lithuania is currently leading in the area of consumption growth (+5.3 %), closely followed by Estonia (+5.1 %) and Latvia (+3.4 %). It is expected that private consumption growth in Latvia and Lithuania will remain strong in both 2016 and 2017, whereas in Estonia, the situation will stabilise. Unlike the post-crisis period, the equalisation of average income levels in the Baltics is expected in 2016 and 2017. It should be taken into account, however, that the average salary level in Lithuania is currently EUR 740, in Latvia – EUR 830, but in Estonia – EUR 1050, i.e. 30 % higher.

Russia to be blamed for weak export performance

In the first nine months of 2015, export levels to Russia from Latvia, Estonia and Lithuania decreased by 21 %, 38 % and 41 % respectively. As a result, export growth has slowed considerably, especially in Estonia and Lithuania. Until now, the recession of Russia's economy and the imposed sanctions have had a comparatively lesser effect on Latvia, which explains the best performance by this country amongst the Baltic States. It is expected, however, that the negative effects caused by Russia will reduce in 2016. First and foremost this will be due to the considerable decrease in the share of exports to Russia. Secondly, it can be expected that export to other markets will continue to grow, i.e. by 5–7 %, which will significantly compensate the negative effects caused by Russia. Therefore, even if we assume that the economic sanctions will persist, the negative effects caused by Russia will be considerably smaller in 2016, as compared to 2015.

Investment differences

The investment cycle in the Baltic States has collapsed and is characterised by the rapid growth of investments in Lithuania (by +10 % in the 3rd quarter), an increased investment growth rate in Latvia (by +6 % in the 3rd quarter as compared to the same period last year) and the falling level of investments in Estonia (by -12 % in the 2nd quarter). In Lithuania and Latvia, the main driver of this performance is growing investments in machinery and equipment (by +28 % and +15 % in the 3rd quarter respectively) which is a positive indicator and could mean stronger economic growth and export potential in the future. Moreover, the investment and GDP ratio in all three Baltic States is currently above the average ratio in EU Member States. It is curious that investments in housing properties in Lithuania have reached their pre-crisis level, whereas in Latvia they range from 25 to 30 % as compared to the levels in 2007 and 2008.

Latvia has had the strongest gross amongst the Baltic States

"In 2015, Latvia has had the strongest gross domestic product growth amongst the Baltic States. Most probably, that growth will be about 2.4 %, whereas in Lithuania it will be closer to 1.8 % and in Estonia – about 1.3 %. Nordea expects that the rate of Latvia's gross domestic product growth next year will be 3 %. A consistently high level of private consumption will be the main driver of growth; government expenditures will also increase; over the last six months, a positive trend has also been observed with respect to investments, and these should grow even more next year. While exports will increase, the corresponding indicators will not be strong. This will mainly be due to the geopolitical disagreements and the cautious environment of global investments. The ability to achieve even higher GDP growth will be prevented by the import of goods and services which, thanks to the purchasing power of residents, will continue to increase the trade deficit, " says Nordea's Economy Specialist, Gints Belēvičs.

.

.

Additional information:

Signe Lonerte, Head of Public Relations, Nordea Latvia, tel.: 6 700 5469, mob.:29 116 146, [email protected]