Nordea investment solutions – stability during turbulent market

In the last two trading days global financial markets experienced the worst selloff in terms of value lost from global capitalization.

News of Brexit led to:

- 10.7% drop in European equity index as of 27.06.2016 compared to 23.06.2016 and;

- 3.7% decline in All Country World index, which represents world equity market.

News stories of the price drops are all over the media, causing investor panic. However it is times like these that emphasize the benefits of actively managed funds, correct asset allocation and diversification.

Investors, who chose their investments wisely, do not have a reason for panic. We are proud, that Nordea model portfolios, which are our main investment recommendation for investors, have weathered this turmoil exceptionally well. During the same period (23.06.2016 -27.06.2016) Nordea model portfolios were demonstrating high stability:

- Aggressive portfolio (90% in equities) declined by 2.7%

- Progressive portfolio declined by 1.4%

- Balanced portfolio was basically flat with a 0.1% decline

- Moderate portfolio grew 0.8%

- Conservative portfolio even managed to grow by 1.8%.

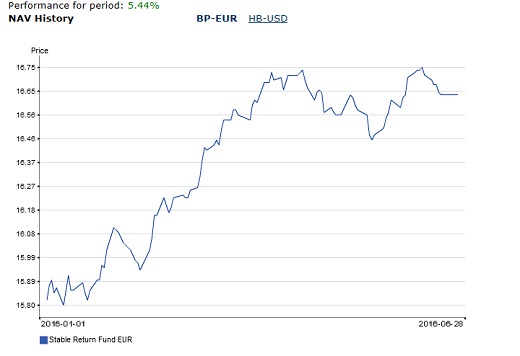

Additional attention should be focused also on Nordea Stable Return Fund that managed to live up to its name, growing 0.2% during the same period.

According to Nordea Asset Management representative Miro Zivkovic, “from any portfolio manager perspective, having been able to generate a flat performance during volatile markets such as the ones we have had over the past week, shows that the portfolio is truly balanced between different return drivers able to truly diversify by protecting clients’ portfolio and generate the decent returns. It is a great achievement and we believe is important to remind our clients that the portfolio is built to try to smooth out these spikes in volatility.”

Anton Skvortsov, who is responsible for Baltic Model portfolio composition points out "that it’s not only the latest 2 days that our funds are showing great performance. Since the start of the year, Stable Return Fund grew 5.0%, Conservative Model Portfolio growth was 5.4% and Balanced portfolio rose 1.9%. "

This all compares to a 5.9% drop YTD in the All Country World index and 16.4% plunge in the European Equity index. At the same time our worst performing portfolio, Aggressive, posted a decline of just 2.6% YTD.

These numbers are the best proof that smart asset allocation and active management can result in significant benefits, especially during turbulent times.

Invest and stay invested with Nordea!

For additional information contact:

Edgars Žilde, Communications Project Manager at Nordea Bank; phone: 6 700 5434, GSM: 28 452 975, e-mail: [email protected]