Nordea Economists: Economic indicators of Latvia show moderate growth. Stable instability in the global economy | Luminor

Nordea Economists: Economic indicators of Latvia show moderate growth. Stable instability in the global economy

-

Moderate growth in the economy of Latvia in the first half of the year.

-

Despite the stable deflation figures at the beginning of the year, the market is currently experiencing the highest inflation rate in recent years.

-

Serious fluctuations in the export performance of Latvia due to the influence of the Russian market.

-

Stable instability in the global economy.

Moderate growth in the economy of Latvia in the first half of the year

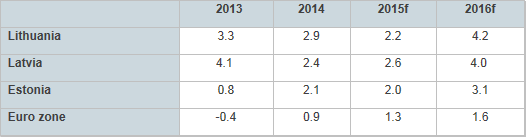

“This year has started off with moderate growth in the economy of Latvia, and according to seasonally adjusted data the gross domestic product of Latvia has increased by 2 % in the first quarter compared to the same period last year. The Nordea forecast for this year is still a bit more optimistic — 2.6 % based on the assumption that economic activity will be growing in the second half of the year. It should be noted that in Lithuania the GDP growth rate in the first quarter was 1.5 %, while in Estonia it was 1.2 %. Thus in comparison with our neighbours the economic activity in Latvia shows a slightly more positive trend,” explains Gints Belēvičs, an economic expert for Nordea Bank in Latvia.

Despite the stable deflation figures at the beginning of the year, the market is currently experiencing the highest inflation rate in recent years

“Although at the beginning of the year the consumer price level in the Baltic states and elsewhere in the euro zone was characterised by deflation facilitated by low energy prices and other raw materials, at the end of the first quarter the inflation rate was already close to zero. This can probably be explained by the decision of the European Central Bank to establish the asset purchase programme, which contributed to the growth of inflation also in Latvia and Estonia. In May consumer prices grew by 1.2 % compared to May last year, and the service sector is the one contributing the most to the increase in consumer prices, as the prices in this sector have lately been growing by more than 3 % per year. The main factor slowing down inflation in Latvia currently is the level of transport and food prices.

Although along with growing economic activity the unemployment rate is decreasing both in the Baltics and in the euro zone, the decrease could be faster. The recent slowing down of economic activity might mean that the reduction of unemployment will also slow down as the economically active population also continues to decrease. During summer, with seasonal employment on the rise, unemployment in Latvia will continue to decrease to approximately 8 %, but in order to reach the same unemployment rate as Estonia, where it is around 6 %, Latvia has to decrease the size of the informal economy,” emphasises the Nordea economist.

Serious fluctuations in the export performance of Latvia due to the influence of the Russian market

A historic peak in production volumes in the processing industry

“During the first months of the year the figures of exports of goods in Latvia increased by 2.5 % compared to the same period last year. The increase of exports is similar to the total growth of the economy during this period, but the monthly fluctuations in this sector have been remarkable. In February and March the export performance was poor and with a negative tendency, while in January and April the increase in exports was over 7 %. A particularly obvious factor facilitating the decrease in the export performance of Latvia at the beginning of this year was the influence of Russia — instead of last year's 10 % share of the total exports, currently only approximately 7 % are being exported to Russia; future trends are negative and declining, which is explained by the ban on imports of Latvian fish products.

In spring we experienced very good results in the processing industry and the latest data show that the amount of production has grown by 10.9% this year compared to April last year, which is not only the largest annual growth since 2012, but also a historic peak in production volumes. Very good results have been also observed in the chemical industry, where the annual growth is approximately 54.6 %. It should be noted, though, that fluctuations in the production volumes in the chemical industry have always been very large; therefore, the overall tendencies in this sector cannot be judged from the data of one month. Judging from the reports for the first quarter, including in the related pharmaceutical industry, the turnover data of which are largely dominated by Latvian producers of medicines “Olainfarm” and “Grindeks”, the situation has been very positive, despite the fact that the influence of the Russian market on both producers is huge. The processing industry was also slightly influenced by the restoration of production activity of the company “KVV Liepājas Metalurgs”, but the latest news about redundancies has caused everybody to question the operation and development of this company, as well as the sustainable influence of the latter on the processing industry in Latvia,” explains Gints Belēvičs.

“In general, it can be said that the economy of Latvia is on a path of moderate growth; however, if we want to move towards the average level of the European Union, the annual growth should be at least 4 % instead of the current 2–3 %. To achieve such a growth rate it is necessary to promote productivity, reform the education system and increase the amount of investment. It is also necessary to find a way to improve the current education system and increase expenditure for science and research and development, especially in the private sector. Crediting will also be very important for the further development of the Latvian economy, as the reduction of credit portfolios is still observed in the banking sector, in the hopes that that next year this sector will also experience growth,” says Nordea economist Gints Belēvičs.

Stable instability in the global economy

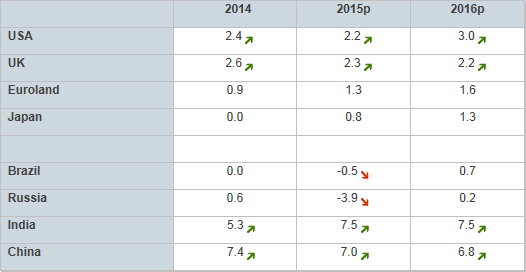

“Last year we witnessed changes that increased the instability of financial markets. Within a year the foreign exchange market experienced depreciation of the euro against the US dollar of up to 25 %, while the value of the Russian rouble against the US dollar decreased by 25 % within a week. The consumer market also faced some surprises caused by a remarkable fall in oil prices, making them approximately 2.5 times lower within six months. At the end of the first quarter of this year the three-month EURIBOR rate of the European interbank market showed a negative tendency for the first time, while the stock market index in Germany grew by 25 % in less than three months. Who’s to blame?” says Chief Economist of Nordea Bank in Lithuania Žygimantas Mauricas.

“The central banks of the major world economies are desperately trying to revive the global economic growth using extreme policy measures. For example, the European Central Bank has recently radically reduced its interest rates to a very low level, and has started an aggressive money printing programme, but the main question — will these activities help reach the goal of reviving the stagnating economic indicators — still remains unanswered. The experience of the USA and Japan best illustrates the possible future scenarios for the European economy. After implementing an aggressive money printing programme, the stock markets in the USA and Japan experienced impressive growth, considerably exceeding the pre-crisis level. Gross domestic product scenarios are totally different: the US economy is currently seeing fast growth and a decrease in unemployment, while the Japanese economy is still stagnating. The Eurozone countries have also experienced a sharp increase in stock prices, but GDP rates are still lagging behind. Does this mean that Europe will repeat the Japanese scenario? Or is there any possibility to repeat the success story of the USA? The outcome is mostly dependent on confidence in the ability to invest, to consume and to compete with competitors on the American, Chinese and Japanese markets. The main precondition for ensuring such confidence is solidarity, and Europe could be very strong provided that it is united. However, political instability prevents Europe from realising its full economic potential,” concludes the economist for Nordea bank in Lithuania.

GDP forecasts (global)

GDP growth forecasts (Nordea June, 2015)

The video of the latest Nordea “Economic Outlook” presentation can be seen here:

www.nordea.lv/nordealive

For additional information: Signe Lonerte, PR Manager, Nordea Latvia,

phone: +371 6 700 5469, mobile phone: +371 29 116 146, [email protected]