Nordea economists: Moderate growth of the Latvian economy; Changes in the labour market from unemployment to lack of staff | Luminor

Nordea economists: Moderate growth of the Latvian economy; Changes in the labour market from unemployment to lack of staff

- After an uninspiring end of 2014 and the beginning of the year, the growth rates of Latvia in the second quarter are the highest in the Baltic states, however, the future is overshadowed by lack of investments.

- The effects of Russia's economic downturn and the embargo are still felt in the Latvian economy. Does Latvia still have anything to lose if the situation worsens in Russia?

- Although the economy of Latvia is growing and wages have considerably increased, unemployment remains at a high level.

- How well are the Baltic states able to implement the guidelines of the European Commission?

- Which countries have proven to be the most flexible in the search of new export markets?

- The real estate market is prospering Lithuania, stagnating in Latvia and shrinking in Estonia.

- China's influence on the global economy has been exaggerated. What will happen when the “Chinese dragon” will run out of fire?

During the first half of the year, Latvian economy displays moderate growth

“After a relatively weak end of 2014 and start of this year, the Latvian economy in the second quarter has already displayed better growth rates, namely 2.7% GDP growth versus the same period last year. These figures are significantly better than the situation in Estonia and Lithuania, where the figures are respectively 1.9% and 1.4%”, explains Gints Belevics, economy expert of Nordea Bank Latvia.

The relatively high level of unemployment is determined by lack of investment in manufacturing and construction

“Lack of investment, especially in the manufacturing and construction sectors, causes structural unemployment to remain on high levels. The battle for skilled workers intensifies more and more, the income level in the country continues to grow rapidly as well, hence the need for unskilled labour is becoming increasingly smaller, resulting in the formation of a certain layer of the unemployed, people for whom it is virtually impossible to return to the labour market due to the lack of skills necessary for the modern economy” says Gints Belevics. “The phenomenon that unemployment declines slowly and employment does not increase while economy and wages are growing may be explained by the high level of structural unemployment. The reason for this is the low level of investments”.

The recession in Russia and the food embargo are still reflected in the Latvian export performance

“Exports of goods to Russia have decreased by more than 20% in the first half of this year and the sectors affected by the embargo conditions suffer most. However, for other manufacturers, it is not easy as well – Russia is facing deep recession while the rouble’s fall following oil prices has reached the lowest point in August this year.

To amend the budget, the government has chosen the easiest way – to take from those who honestly pay taxes and receive high salaries by Latvian standards

“In the process of determining the annual budget for 2016, the government not only has not kept its promises regarding tax transparency in the nearest future and is not only going to trespass the law on personal income tax, which provides personal income tax rate reduction to 22% from 1 January 2016, but also has engaged in creativity of dubious quality by proposing introduction of a “solidarity tax” which directly and painfully affects almost 5,000 Latvian citizens. A disproportionately high tax burden is being imposed on these citizens and their employers. One might conclude that the Ministry of Finance has chosen the easy route – not to fight the shadow economy but to “snatch” from the pockets of the population that might be called the Latvian middle class”, explains Gints Belevics, economy expert of Nordea Bank Latvia.

Prospects for the economic indicators of the Baltic states differ

“The economic performance of the Baltic states continues to display a relatively high resistance to the economic crisis existing in Russia. Domestic consumption stimulated by the rapidly growing level of remuneration, general decrease of unemployment rate and low inflation remains the main engine of economic growth in all three Baltic countries. Nevertheless, economic growth prospects for Lithuania and Latvia have been reduced, which is explained by the downturn in export performance in relation to the Russian market in the case of Lithuania and by the slow investment growth in the case of Latvia”, explains Zygimantas Mauricas, economist of Nordea Bank Lithuania.

Changes in the labour market from unemployment to lack of staff

“The modern labour market situation started to develop already during the 2008–2010 crisis: during three years, the number of the employed in Estonia decreased by 15%, by 14% in Lithuania and by 21% in Latvia without ever returning to the pre-crisis level. As a result, a significant portion of potential employees emigrated or became unemployed for a long term with little likelihood of ever returning to the labour market. The crisis also led to structural unemployment since employment decreased mainly in the sectors where masculine labour is necessary: construction (-48%), manufacturing (-21%) and agriculture (-24%), while there was a moderate decline in employment in the private sector and public sector which employed mostly females: by 9% in the private and by 7% in the public sector. As a result, Lithuania and Latvia are still the only two member states of the European Union, where employment is higher for women than it is for men.

Lack of investments in manufacturing and construction together with the rapidly growing employment rate in the servicing sector, especially in specific sectors, has led to a situation where there is lack of unskilled labour in construction, manufacturing and agriculture, as well as highly qualified labour with specific competencies and knowledge in the servicing sector. This explains the phenomenon of the Baltic states, when both rapid wage growth and high unemployment rates are simultaneously recorded. During the last two years, wages have grown fastest of all in Latvia while the employment rate has grown slowest of all in the Baltics. If such a phenomenon will prevail for a long period, it may increase inflationary pressures, erode international competitiveness, increase income inequality.

How to fix the situation in the labour market?

First of all, it is necessary to promote investments in infrastructure and construction projects to stimulate the unskilled long-term unemployed to return to the labour market, taking up temporary jobs and re-training at a later stage. Secondly, investment should be promoted in the manufacturing industry, especially in the regions, to increase employment in the manufacturing sector. Thirdly, investment should be promoted in knowledge-intensive servicing sectors to attract and retain highly qualified and highly mobile talents. Without improvements, the Baltic labour market will consist of many relatively expensive servicing sector workers with medium level skills. As a result, it will be difficult to attract employees and there will be a significant number of low-skilled specialists who will have been unemployed for a long time and will have previously worked in the construction or manufacturing sector thus creating a very high pressure for the social security system.

Transferring of the export market to the West

The Baltic exporters to Russia are currently facing a triple problem: the trend of depreciation of the rouble, economic sanctions and decline of the Russian consumer’s purchasing power. It is unlikely that the economic situation in Russia will recover in the near future so that the Baltic exporters will have no other choice but to continue to restructure the exports away from Russia. From a long-term perspective, the current events in Russia are more reminiscent of the Russian economic crisis which took place from 1998 to 1999 rather than the situation in 2008 and 2009 when the share of exports to Russia fell from 20-25% to 5-10% and never returned to the pre-crisis level. Consequently, the biggest challenge to the Baltic economy will be self-transformation given that being the bridge between the East and the West it may soon become a periphery of the European Union, standing at the newly built wall of economic sanctions.

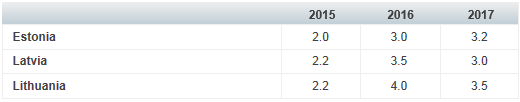

Prospects for the gross domestic product (GDP) (the Baltic states)

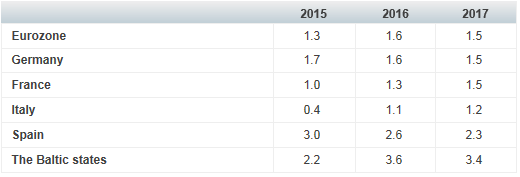

Europe: positive economic indicators in the Eurozone

The retaining of Greece in the European Union has been a strong push that has significantly strengthened both the EU and the whole Eurozone which is ready for positive surprises. The relatively rapid economic recovery of the Southern European countries such as Spain, Italy and Portugal, is one such surprise. For example, the Spanish economy is currently experiencing a more rapid growth than German and the Baltic economies. Italy is also slowly coming out of recession and even the GDP of Greece displays a positive trend despite of economic and political fluctuations. These economic indicators are particularly encouraging for Germany whose exporters have so far mainly relied on Russian and Chinese markets.

Prospects for the gross domestic product (GDP) (European countries)

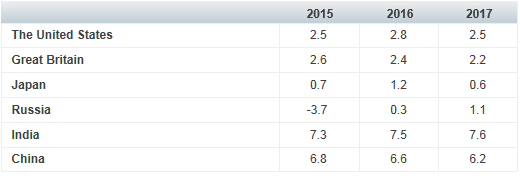

Global economy: What will happen when the “Chinese dragon” will run out of fire?

“We have learned a lot from the comparatively recent global economic crisis of 2008 and 2009: “if somebody sneezes in America, the whole world will get runny noses”. This time, China has provided a reason for worries by outpacing the United States in respect to economic indicators. Basically, one could say that the Chinese economic model based on the ever-growing investment and export performance is not sustainable. However, instead of transforming from the “global factory” to the “global supermarket”, China has established itself as the “global construction site” powered by rapidly growing loans. It should be noted that the Baltic states have experienced a similar scenario ten years ago. China is also rapidly losing international competitiveness in view of its strong currency and rapidly growing wages. For example, the average salary in China calculated in euro has more than doubled within the last five years compared to the figures of the Baltic states, by reaching approximately 680 euros. Thus, China's decision to devalue its currency, causing panic in global financial markets in late August, is not surprising”, Zygimantas Mauricas, economist of Nordea Bank Lithuania, explains.

Nevertheless, the amount of consumption in China still lags far behind both the United States and the European Union, namely, the United States consumes about four times more than China while Western countries – over ten times more. Also, there is virtually no “poisoning threat” “by China's financial sector to the global financial system. Thus, China's low landing will be more reminiscent of the economic crisis in the late nineties than that of 2008 to 2009. The biggest losers in such a scenario could be the countries exporting goods to China, such as Russia, Brazil, Australia, and countries which have close trade and investment relationship with China, such as Taiwan, South Korea, Japan, Malaysia and Singapore.

Prospects for the gross domestic product (GDP) (the counties of the world)

The repeated video broadcast of the Economic Outlook by Nordea in Latvia will be available through the link here.

The presentation of Nordea Group Economic Outlook is available through the link here or on the website here.

Additional information: Signe Lonerte, Public Relations Manager of Nordea Bank Latvia, phone: 6 700 5469, mobile: 29116146, [email protected]