Nordea Group’s fourth Quarter and Full Year Results 2014 | Luminor

Nordea Group’s fourth Quarter and Full Year Results 2014

CEO Christian Clausen’s comments on the results:

“We are in 2014 delivering a robust result with stable revenues, decreased costs and improved credit quality leading to a 9%[1] increase in operating profit. This is despite a challenging environment with low growth, low rates and increased geopolitical tensions.

We have seen a record high flow of assets of EUR 18.6bn and improving market shares in the savings area. In the corporate area we have further consolidated our position being ranked as the leading bank for large corporates in the Nordics by Greenwich as well as number one in Nordic Equities by Prospera.

Our capital position has continued to improve during 2014 mainly due to a strong capital generation corresponding to 2.1% of REA pre dividend. The Board of Directors proposes a dividend of EUR 0.62 per share (EUR 0.43). Common Equity Tier 1 capital ratio improved by 1.8 %-points to 15.7%.

For 2015 we are prepared for another year with low growth and low interest rates, and continued changed customer behaviour. Thus, we will deliver on our cost and capital efficiency plans to secure our strong financial foundation. We will continue to develop our services to meet the changing needs from our customers and invest in our IT platform to secure that we also long term provide even more personalised and convenient solutions for our customers.”

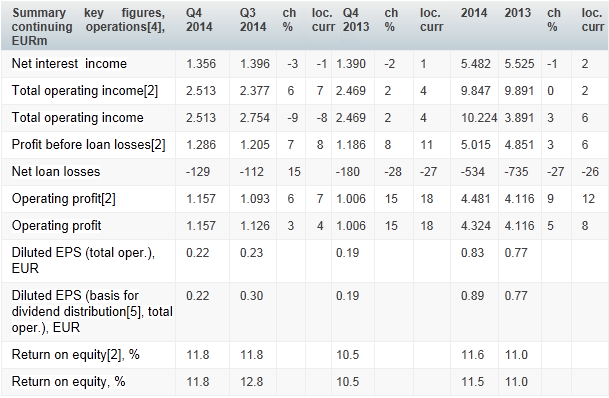

Full year 2014 vs. Full year 2013 (Fourth quarter vs. Third quarter 2014)[2]:

- Total operating income unchanged excl. non-recurring items[2], in local currencies

+2%[2] (+6%[2], in local currencies +7%[2]) - Total expenses -4%[2], in local currencies -1%[2] (+5%[2], in local currencies +6%[2])

- Operating profit +9%[2], in local currencies +12%[2] (+6%[2], in local currencies +7%[2])

- Common equity tier 1 capital ratio 15.7%, up from 13.9%[3] (up to 15.7% from 15.6%)

- Cost/income ratio down to 49.1%[2] from 51% (down 0.5% to 48.8%[2])

- Loan loss ratio of 15 basis points, down from 21 basis points (up 3 bps to 15 bps)

- Return on equity 11.6%[2], up from 11.0% (up to 11.8%[2] from 11.2%[2])

- Proposed dividend EUR 0.62 per share, up from EUR 0.43 per share