Paul Samuelson, Nobel laureate and one of the most influential economists of the late 20th century, once said: ‘Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.’

‘This is an excellent way to highlight a truth about long-term investment that is missed by many investors. Investing for the long term is fairly boring – you just invest in a well-diversified portfolio according to your risk profile and investment goals and rebalance it once in a while. There is no action or excitement, which many people expect, as this is the way investing is often portrayed in various sources’, says Nordea bank Savings Latvia team leader Anželika Dobrovoļska.

Choosing winning stocks is considered to be the main prerequisite when it comes to successful investing. And there are in fact many different services and pundits who can suggest which specific stocks you should buy at any given moment. What they usually do not mention, however, is that it is extremely difficult to choose winning stocks consistently for any considerable period of time. What is more, there are very few people, even among the experts, who can really do this, and most stock-picking services actually underperform the market.

But why is beating the market by picking stocks so difficult? As the market is represented by an index, which is the average of its constituents, then it seems logical that 50% of stocks should outperform and 50% underperform the index. However, this is not true. Research by Meb Faber, who studied the behaviour of 8,054 stocks in the period from 1983 to 2007, shows that, in fact, 64% of stocks underperform the index, while 39% (two out of five) of stocks have a negative lifetime total return. What is more astonishing is that the entire return on the index came from just 25% of stocks, while the other 75%, collectively, had a total return of zero. As a result, if an investor somehow avoided the best 25% of stocks, their total gain from 1983 to 2007 would be 0%. So the odds are really stacked against stock pickers.

Nordea bank Savings Latvia team leader Anželika Dobrovoļska

Another big mistake by individual investors is their desire to time the market. For various psychological reasons, most investors fail in this endeavour. Individual investors are usually prone to do what everyone else is doing, i.e., buying what is currently hot. This actually leads to people buying high and selling low, the exact opposite of what is needed. Additionally, a lack of diversification makes investors underestimate the real risk to their portfolio, as assets are in fact highly correlated. Finally, loss aversion, or the fear of loss, leads to the withdrawal of capital from the market at the worst possible time.

All the above-mentioned factors lead to significant and consistent underperformance on the part of the average investor. As the latest Dalbar research has shown, the average equity investor underperformed the S&P 500 by a margin of 3.66%, meaning that while the S&P was up 1.38%, the average investor lost 2.28%. And this is not just a phenomenon from the last year; the average investor has been consistently underperforming the market year after year. During the last 20 years, for example, the S&P 500’s annualised return was 8.19%, while the average investor just got 4.67% annually, a gap of 3.52 percentage points.

So what can investors do to avoid underperformance and achieve their long-term goals? The answer is very simple: invest in a well-diversified portfolio that matches their personal risk profile and hold it for the long run. Diversification is rightfully called the only ‘free lunch’ in finance, as it allows one to achieve higher levels of return without exposing oneself to greater risk. This is because of the simple fact that not all asset prices move in tandem with one another, balancing the fluctuations in the value of the portfolio.

Additionally, there is a simple strategy that allows investors to buy low and sell high, enhancing returns. This is regular rebalancing, which can add about 0.2%-0.8% to one’s annual return. This is because, when rebalancing, you sell assets that have gone up and add assets that have declined in value, a natural way to buy low and sell high.

"As Ben Graham, the father of value investing said, “The individual investor should act consistently as an investor and not as a speculator.” This means that the optimal strategy for a long-term investor is buying and holding a well-diversified, global portfolio and occasionally rebalancing it to capture the benefit of diversification’, concludes Nordea Savings Latvia team leader Anželika Dobrovoļska.

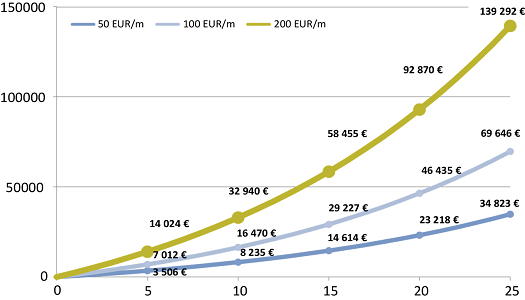

How regular investments create wealth:

* The following graph shows the theoretical value of the portfolio at the end of each investment period, assuming that during the entire investment period the profit interest rate remains unchanged. The real return on investment can be both positive and negative.

Disclaimer

Historical returns shown in the article are solely for informational purposes. Historical returns cannot be regarded as a safe indicator of future investment results – actual returns may differ significantly from the ones specified in this article. This material is not investment advice or an offer to carry out transactions involving financial instruments. Prior to making decisions about investments, we encourage customers to read the terms and conditions of each specific investment product and evaluate whether a particular investment product is appropriate for the customer’s investment portfolio, interests and risk profile. Nordea bears no responsibility for any losses that the customer might incur by relying on the information contained in this article.

For additional information contact

Edgars Žilde, Communications Project Manager at Nordea Bank; phone: 6 700 5434, GSM: 28 452 975, e-mail: [email protected]