Economy will be "frozen" for a while | Luminor

Pēteris Strautiņš, Luminor economist

Economic insights Latvia: spring 2020

These are extraordinary times for the world and they are rapidly becoming extraordinary for Latvia and not only for the people who have to cancel their travel plans. It is becoming clear that there will be a time – several months or even several quarters when physical security will trump all other concerns. Is is becoming increasingly obvious that the epidemic cannot be stopped without significant changes of lifestyle and modes of business operation. There are sectors that have entered totally new reality, where some businesses have been forced to stop their operations entirely. In others there are few changes apart from technical adjustments in the working processes. We expect that economic activity will shrink sharply in Q2, will start to recover in Q3, but growth in annual terms will not come back until Q4. Next year the growth will be very strong, but GDP will not quite return to the level where it would have been without this global drama. We assume that the scenario of the epidemic will be similar to the one of China where very drastic measures allowed to stop the spread of the virus in a couple of months.

Recent economic developments and main forecasts

The global health crisis has made the economic developments very unpredictable. So most of this report is devoted to what happened in 2019 and what could the developments be like when some sort of global normality returns.

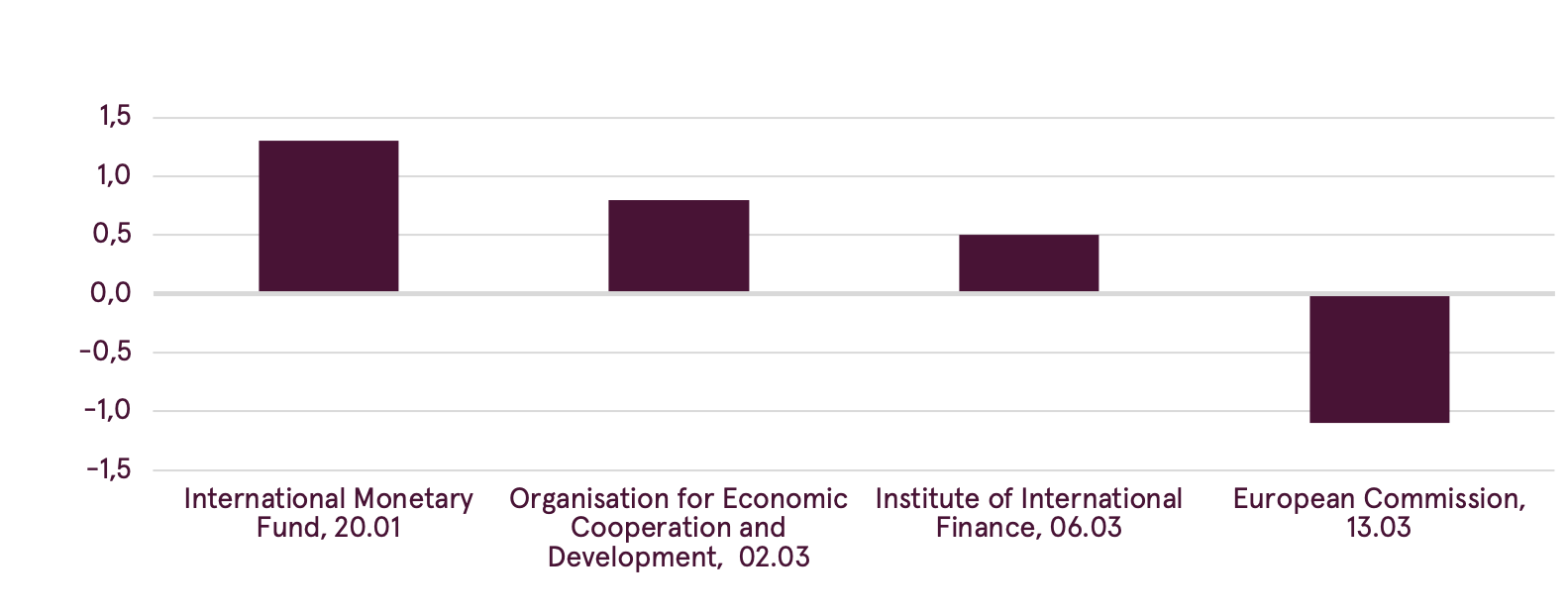

The attached chart shows how much the forecasts about euro area growth by international institutions have changed in a short period of time.

Year 2020 GDP growth forecasts for euro area by international institutions

Latvia is entering this highly unusual period with a weaker growth rate than other Baltic states. Unfavourable external events exposed its structural weaknesses in 2019. Latvia’s economy has the highest share of raw material and energy transits and commodity timber products in exports among Baltic states. Also the recovery of internal demand sectors from previous crisis has been weaker. Unlike in neighbouring countries, housing market is continuing to languish. Latvian households have done a lot to strengthen their finances, but this has come at a cost of sacrificed short-term growth.

Latvia is entering this highly unusual period with a weaker growth rate than other Baltic states. Unfavourable external events exposed its structural weaknesses in 2019. Latvia’s economy has the highest share of raw material and energy transits and commodity timber products in exports among Baltic states. Also the recovery of internal demand sectors from previous crisis has been weaker. Unlike in neighbouring countries, housing market is continuing to languish. Latvian households have done a lot to strengthen their finances, but this has come at a cost of sacrificed short-term growth.

Growth rate in Latvia in 2020 was bound to be quite weak as the country goes through a phase of export sector adjustment. Given the unprecedented circumstances in the world economy, economic recession now looks inevitable this year. However, it will probably be short and will be followed by a strong rebound in 2021 and 2022. Life will continue after the current crisis. Even before the ongoing unusual events the next year was likely to be good, a time of rebound from slowdown induced by export sector issues. Now one can imagine economy growing at extraordinary rates, even double digits in the most radical scenarios, but that would be mostly a reverse mirror image of even more extraordinary events in 2020.

Our baseline scenario is not so extreme. On the basis of information available on Friday, March 13, we predicted that Latvia’s GDP will shrink by 1.1% in 2020, but rapid recovery will start already in the second half of this year and in 2021 GDP will grow by ca 5%. There will be weakness both in internal demand, for example, private consumption will decline by 0.5% and in exports that are likely to decline by more than 3%. We think that the increase of unemployment to be quite mild as government is expected to implement active labour market policies. Nevertheless, the average level of unemployment will be more than 1 percentage point higher than in 2019.

However, we, Luminor economists have to recognize that there are many things we just do not know. The value of this report is to encourage thinking and prepare for various scenarios. As Dwight Eisenhower said, plans are useless, but planning is essential.

Exports

In 2019 real growth of goods and services exports gradually decreased to 2,0% from 4,0% in 2018. Performance in sectors was highly contrasting.

Apart from rapidly shrinking financial services, other so called “white collar” service exports grow rapidly, they contributed similar additional export income per capita as in Estonia and Lithuania. The Baltic country where smart service exports contributed most to economic expansion was Lithuania that has benefited from active policy measures for attracting investment in this sector.

Growth of white collar service exports per capita in 2019, in euros

Export growth has been a key factor behind the growth of value added in commercial services by 6.5%, making it the most rapidly growing large sector last year, almost reaching the size of the transport sector. Prospects here are good apart from possible impacts on work organization in the new circumstances. According to recent internal industry survey, shared-service centres planned to increase employment by close to 10% on average. Growth of IT service exports in 2019 was slow by recent standards (11%), but still respectable. Value added in software production and consulting grew by 9.1%. The overall 8.8% growth in white collar service exports contrasted with 6.7% decline in transit (railway and ports). Trucking service exports expanded by 21.3% after decreasing by 7.6% in 2018. Aviation and tourism sector has become very important over the recent years, last year its exports revenue grew modestly, by 1.2%. Now any comments on its near-term future are superfluous, but long-term future remains good.

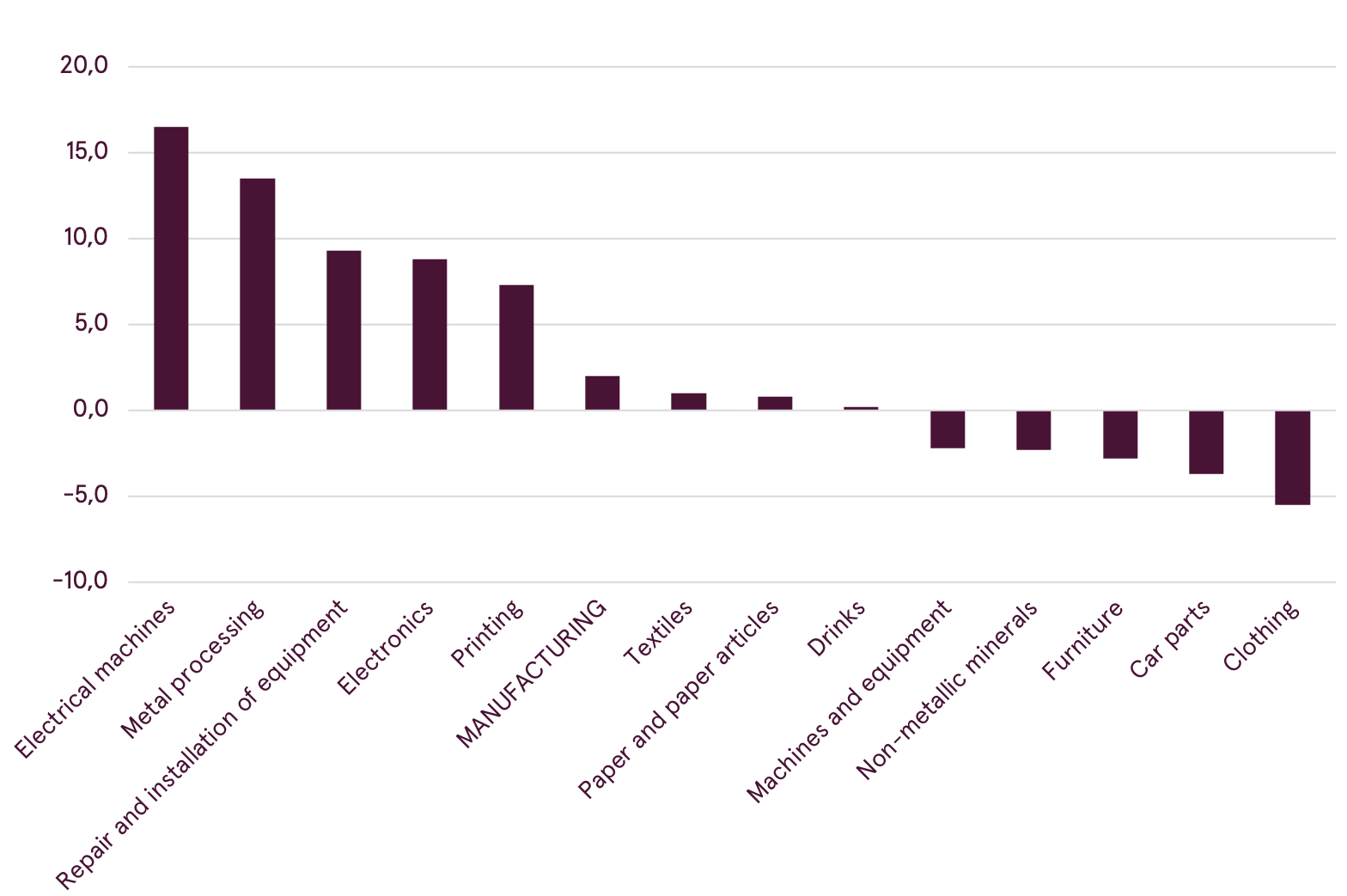

Also in merchandise service exports the picture was very contrasting last year. In this case production data provide the most precise picture as external trade data are strongly affected by re-exports. Output in electrotechnical manufacturing expanded by 16%, it was up by 13.5% in metal processing. Overall growth in engineering sectors was ca. 9%, a very respectable result in the difficult market conditions. The biggest unpleasant surprise came from timber processing that decreased by 0.2% after remarkably long and strong expansion. The mishap was mostly caused by weather-related oversupply in Central Europe and its impact on prices. While insect invasions and related market swings could cause further trouble, the luck of timber sector will come back at some point, as it has done in the past. Unfavourable natural circumstances will pass, some competitors in higher cost countries will exit the market.

Change of output in manufacturing sectors in 2019

Omens for the year 2020 were quite good for engineering sector as the capacity expands. Also order levels at the beginning of the year pointed at further growth. Now we can only hope for the health crisis to end. Timber sector could hope for a modest rebound, but conditions in markets remained quite difficult at the beginning of the year despite modest rebound in prices. Food processing started the year with a modest growth and could hope for further improvement. Milk processing is overcoming the impact of temporary factory closures, even the long-suffering fish processing is recovering. Unlike other sectors, food processing could even benefit from the virus crisis as people stock up reserves.

This is an extraordinary, rapidly changing situation. Issues come up that could never have been imagined before. For example, even before border closures in Central Europe some truck drivers refused to go to Italy because they were afraid to get sick. Truck owners are worried that their vehicles might get stuck in remote places.

There are also good news. Companies are acquiring new clients, because European companies have changed procurement policies, deciding not to rely on Asian supplies too much. Textile and apparel sector is reporting plentiful orders. Latvian manufacturing is relatively less integrated in complex global value chains. Most of the time this is a disadvantage. Currently it is good that relatively large share of raw materials are locally produced, like timber, grain and milk or are commodities available from multiple sources like simple steel products.

While 2020 will be tough, it is also preparing ground for a confluence of favourable circumstances in 2021 and 2022. Overall export growth has not been great, but there have been significant favourable structural developments that will lead to export growth acceleration sometimes in the future. External trade data are strongly affected by re-exports, but manufacturing turnover paints a picture that is broadly correct. The share of metal processing and machinery in total manufacturing exports has increased from 12.8% to 21.2%. Together with electronics (for which the data are not published) the share probably increased from ~15% to ~26%. Including also chemicals and pharmaceuticals (for which data are partially available), the estimate share grew from roughly 1/5 to 1/3. The increase last year was about one percentage point.

If we assume that the growth rate of 2015-2019 will be repeated in manufacturing sectors in 2020-2030, structure of manufacturing will change rapidly, also leading to growth acceleration to >6%. It will not happen exactly like that, but this is a useful mind game. The structure of manufacturing has already changed significantly in the after-crisis period.

Internal demand sectors

Household consumption in 2019 grew a bit faster than the economy, at 3.0%, but this is significantly slower pace than a year ago (4.4%). Growth of fixed investment slowed much more sharply, from 15.8% to 3.1%, as EU fund flows stabilized at a high level.

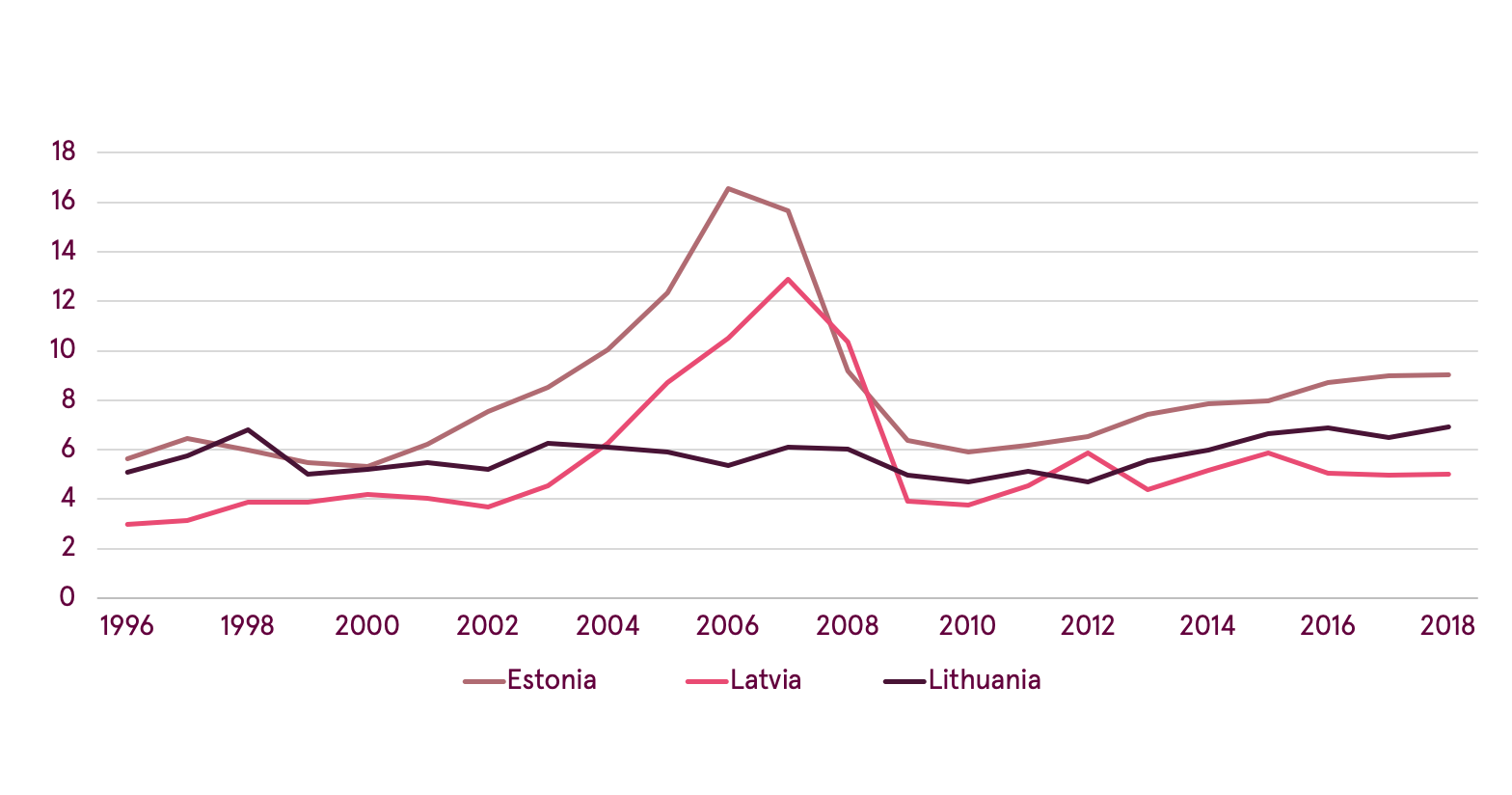

While in the long run Latvia’s economic performance depends mostly on exports — this is a self-evident and often repeated truth, right now it could benefit a lot from faster consumption and investment growth. Consumer confidence in Latvia is just at the historic average while it is above that in other Baltic states. While it is to some extent a reflection of recent export successes, there are also well-established positive interactions between lending, household investment, employment, consumer optimism and lending. This self-sustaining upward cycle is still sorely missing in Latvia, or at least it is much weaker. Household investment in 2018 was 9.0% of the disposable income in Estonia, 6.9% in Lithuania, but only 5.0% in Latvia.

Household investments, % of disposable income

Latvian government will have to do the utmost to preserve consumer confidence through active labour market measures, support to businesses. If the corona virus scare leads to a renewed cycle of deleveraging, impacts on Latvia’s future will be highly damaging.

Loans to households in 2020 grew by less than 1% compared to ca. 6% in Estonia and Lithuania. This also means that the upswing driven by mortgage lending and housing investment could be stronger in Latvia in the future, but this comes at a cost reduced activity now. Latvian households have been extremely prudent. Savings grow rapidly, but household borrowing started to increase only slightly last year. It is good to increase financial safety, but this involves trade-offs.

To stimulate the economic recovery it is more important than ever to get RailBaltica project back on track. A while ago it seemed that the project would storm into an overheated labour market. Now we can’t be so sure about that. It could be very helpful for pulling the economy out from the slowdown.

It seemed very likely that Latvia will achieve positive migration balance in 2020, like Lithuania did in 2019 and Estonia already five years ago. Now predicting almost anything has become a very risky enterprise, but there is still a fair chance of that. It will inevitably happen at some point in time.

Labour market and inflation

Despite slower growth situation for employees remained advantageous throughout 2019. Wage growth remained persistent, slipping very slightly toward the end of the year. The annual average slowed just slightly from 8.4% to 7.2%. It was bound to fall to 6% or slightly below in 2020 because of economic slowdown and absence of minimum wage rise. This year wage growth is one of the indicators that has become quite unpredictable in 2020 as no one can know how companies will cope with temporary difficulties, historically in Latvia they have often resorted to temporary wage cuts.

Wages have increased more rapidly than productivity over several years. This is often presented as a problem and that is indeed a competitiveness risk. However, without wage growth Latvia will continue to lose people and that will be even more harmful for its future. Population is still declining, but there is a chance that, like in Estonia and now also Lithuania, the migration balance will turn positive. Plus, strong wage growth is an extra push for raising productivity.

Demography is extremely important in the long run and can even affect the economy in the next couple of years. The rapid growth in Lithuania is already being supported by rapid rise of immigration. Previous downturn spiral of weak growth and falling population has been replaced by upward spiral of mutually supporting economic and demographic developments.

Governance issues – business and municipalities

Slower growth in 2019 and expected further slowdown in 2020 is a result of bad luck and past mistakes. Steps are being made to address them. Reforms of regional governments, higher education, while controversial, as always, will be favourable on balance.

Apart from slightly unfortunate export specialization and weak recovery in cyclical internal demand sectors, Latvian economy suffers from another problem — weak ability of local enterprises in crucial sectors to drive forward their development, with a partial exception of timber and food, processing, IT and construction service exports. The growth acceleration in the next years is expected to be largely driven by foreign-owned enterprises. For example, the additional supply of office buildings, crucial for further expansion of white-collar services will be a result of the efforts of Lithuanian, Estonian, Swedish and Norwegian developers. Factory expansion in Liepāja, the fastest growing industrial town happen on the orders of mostly Swedish and Danish companies though the contribution of the local industry leader UPB is remarkable. Picture looks similar in retail sector.

Why this has happened like that? One obvious explanation is the short time the country has been given to develop the market economy. However, there are some handicaps vs. other Baltic states. Perhaps one can blame also media environment where sometimes trivial business environment issues are turned into insurmountable obstacles. Ideas and preconceptions have a lot of power over human minds, thus they shape reality.

Another important governance issue is that of municipalities, their ability to attract investors. The last couple of years have revealed sharp contrasts between regions and towns. In the following years a lot will depend on the quality of development policies in Latvia’s regions, primarily large towns. Historically a lot of attention has been focused on national-level policies like taxes, energy policy. These are important, but the decisions about the placement of factories are very much influenced by the quality of local governance.

There are towns that can boast an impressive portfolio of industrial development projects already completed or under construction, first and foremost in Liepāja. There are hopeful signs that things are starting to move forward in other places after a period of stagnation. Rēzekne could be mentioned here as an example, several enterprises are planning to set up or expand production there, the news has not yet quite reached media headlines, but it will.