Markets shrugged off first rate hike in US

- Equity indexes partially bounced back

- FED raised interest rate up to 0,5%

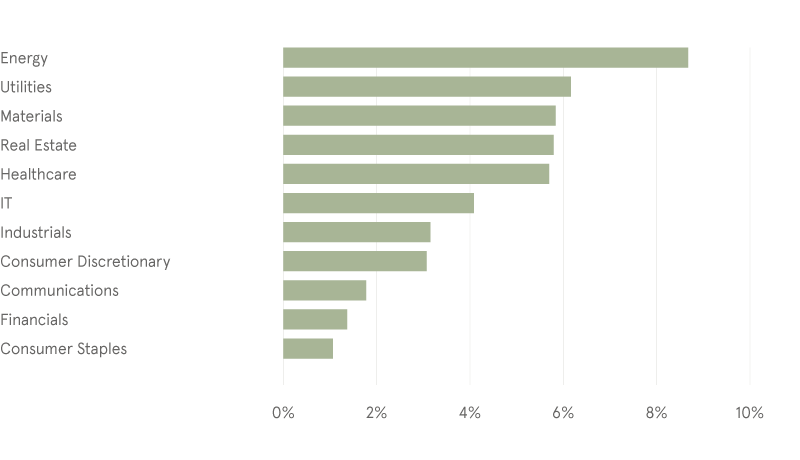

After bit more than 10% correction from the peak reached at the start of the year developed market stock index (MSCI World NTR EUR) bounced back during second part of March. Market participants still continued to flock toward more defensive sectors. It is also important to note, that emerging market index (MSCI Emerging market NTR EUR) demonstrated sharp moves down and up and ended March in negative territory. Meanwhile bonds suffered due to selling pressure from increasing probability, that interest rates will be raised numerous times this year and possible balance sheet reduction by the Fed.

World equity sectors in euros 2022-03

Source: Bloomberg L.P.

US Fed chairman Jerome H. Powell voiced worry about inflation and declared, that central bank is ready to do what it takes to control rapid price increases. This signaled to market participants, that soon rates could be raised more aggressively than last month, when the Fed declared its first rate hike since 2018, amounting to quarter point increase.

Selling pressure subsided a lot in Emerging markets after Chinese authorities tried to ease stress in financial markets vowing to be proactive to respond to the need to boost economy. It is planned to introduce new policies to handle property developers’ risks and push forward rectification of major internet companies and support foreign listings. Before this announcement market participants were willing more to sell Chinese IT companies, which were listed on US exchanges fearing further regulatory crackdown and heightened risk of sanctions should China provide aid to Russia for the war in Ukraine. One of the biggest Chinese IT companies Alibaba Holdings share price had lost about 75% from peak reached in 2020 and Tencent declined more than 60% before substantial bounce back in March.

Worry about global supply chains deepened after China was forced to announce new lockdowns in the biggest cities. At the end of the month newly confirmed COVID cases showed no signs of losing momentum and financial and trade hubs like Shanghai and Shenzhen took steps to limit spread of the virus. In some cases “closed loop system” was tested where factory workers are living and working separately from general public.

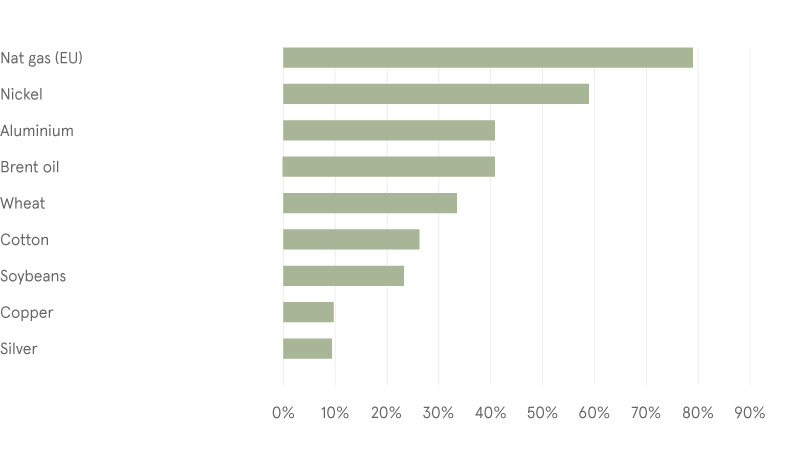

Commodities prices in 2022 in euros

Source: Bloomberg L.P.

War in Ukraine, new COVID wave and its impact on supply chains wreaked chaos in commodities markets and impacted whole world. Most notably nickel, used in batteries and coins, suffered short-squeeze and London Metal Exchange (LME), which suspended trading for a week and cancelled billions of dollars’ worth of transactions. Price of Nickel hit a record of 101 365 USD a ton on March 8 and forced LME to double the size of its default fund. Exchange came under furious criticism for its handling of this nickel crisis and traders remain wary of threat of another squeeze as there are still large short positions in the market.

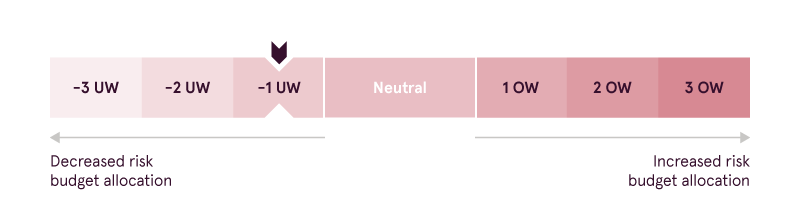

“House view” update

In March Luminor Investment management team remained cautious and maintained underweight risky assets and kept heightened exposure to defensive sectors (utilities, healthcare and energy). The investment team continues to monitor already more than month long war in Ukraine, its impact on global economy. Increased political and military tensions, new supply chain disruptions and huge moves in commodity prices could materially impact growth perspectives.

Warnings

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from the Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, represented within the Republic of Latvia by Luminor Bank AS Latvian branch, reg. No 40203154352, address: Skanstes iela 12, LV-1013, Riga, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Latvian Financial Supervisory Authority (Finanšu un kapitāla tirgus komisija). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Latvia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question, and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument, a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to internal rules on sound ethical conduct, management of inside information, handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.