Active IPO

| Company | IPO subscription | Event type | Price | Ticker | Additional information |

|---|

We use cookies to make your browsing experience better. Agree and share a cookie with us!

Become a shareholder of Baltic companies!

Become a shareholder of Baltic companies!

In order to be able to submit orders for the purchase of shares, you need an active investment or financial instruments account and a Luminor current account.

You can conclude an investment account or financial instruments account agreement:

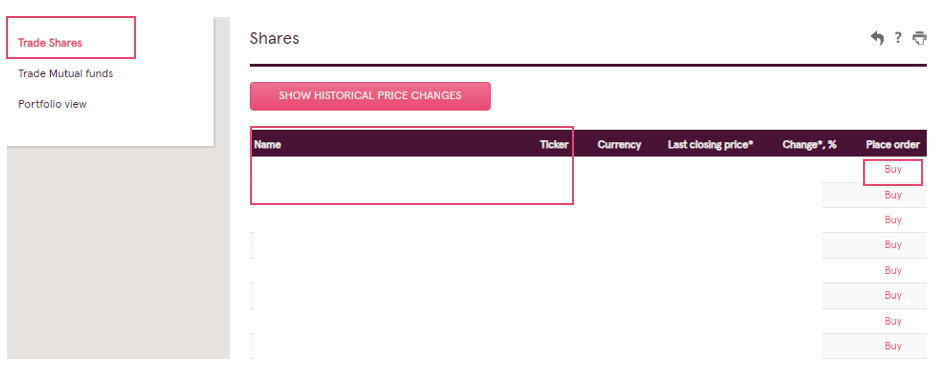

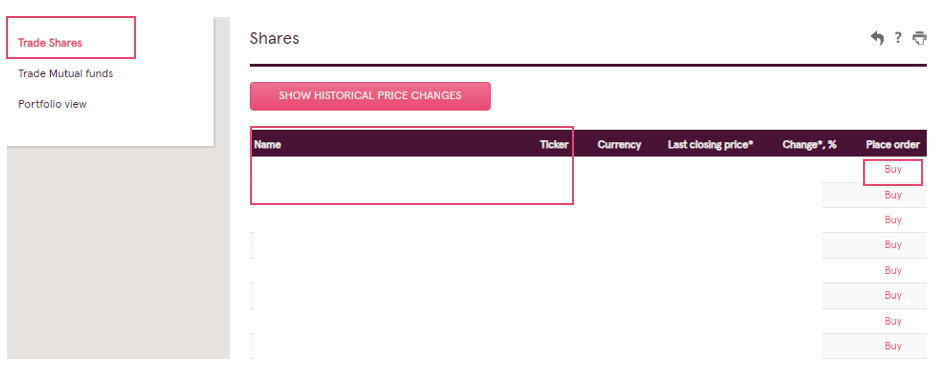

The order can be submitted in the Luminor Internet bank in the section Deposits and Investments / Financial Instruments – Open local instrument platform, in the section Trade Shares by submitting an order to buy the shares of the company you want to purchase.

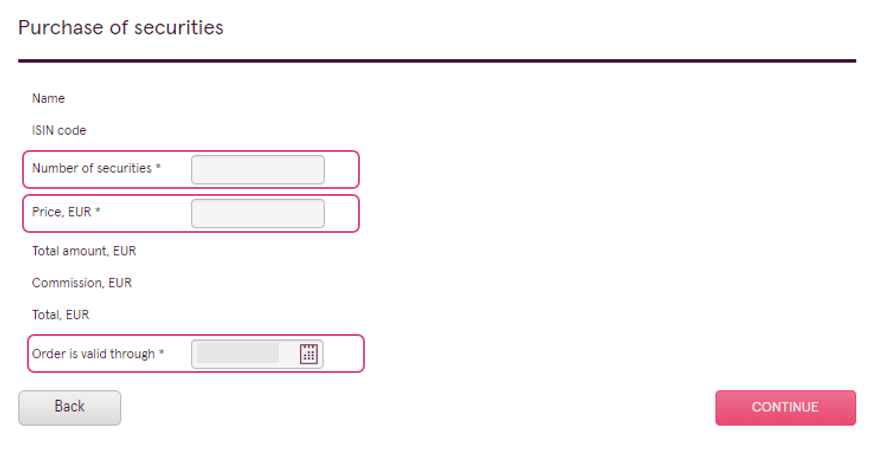

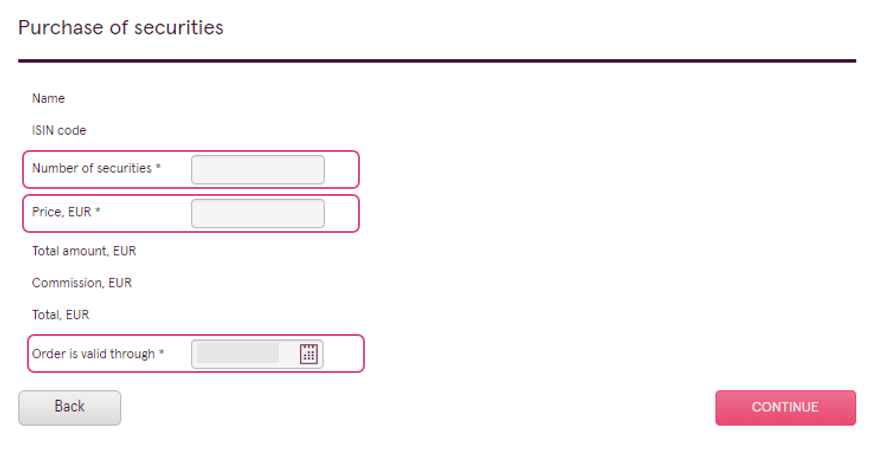

In the purchase order window, you must specify:

The submitted order can be withdraw by sending a message in the internet bank. The message must indicate the number of the order. Only unexecuted orders can be withdrawn.

The commission fee for the execution of orders for shares of Baltic companies is 0.10% of the respective transaction amount, min. EUR 2.00. Before confirming the order in the Internet bank, you will be able to see the expected amount of the commission fee for your order you submitted.

The order can be submitted in the Luminor Internet bank in the section Deposits and Investments / Financial Instruments – Open local instrument platform, in the section Trade Shares by submitting an order to buy the shares of the company you want to purchase.

In the purchase order window, you must specify:

NB! The bank will cancel the received orders in which the price or the validity period of the order does not comply with the IPO rules.

The time frame for subscribing orders is set by the company and can be viewed in the prospectus of the relevant IPO.

In the Current IPOs section below, you can see the date and time by which an order must be submitted so that it can be executed within the set time frame of company.

Orders submitted after the specified closing time will be withdrawn by Bank.

The submitted order can be withdrawn by sending an Internet bank message until the time specified in the section Current IPO information.

The message must indicate the number of the order to be withdrawn.

More information about the IPO is available in Nasdaq Baltic homepage section Upcoming events and/or on the website of the respective company.

I have additional questions

All investments entail risks and may result in both profits and losses. Investors should carefully consider their financial situation in order to understand the risks involved and ensure the suitability of their situation prior to making any investment, divestment or entering into any transaction. You are responsible for your investment decisions; therefore, before making a decision you should get acquainted with all investor protection documents, including, but not limited to, description of financial instruments and related risks, prospects of funds or of financial instruments available here.

Past performance is not a guide to future performance and should not be the sole factor of consideration when selecting an investment. If the return earlier was positive, it may not be the same in the future. The price of the investments may go up or down and the investor may not get back the amount invested. Your income is not fixed and may fluctuate. The value of investments involving exposure to foreign currencies can be affected by exchange rate movements. The levels and bases of, and reliefs from, taxation can change and it may not suit you.

None of the information contained herein constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

Luminor does not provide recommendations in Luminor Investor Platform. Luminor does not take into account any particular client’s investment objectives, special investment goals, financial situation, specific needs, demands, knowledge and experience. Therefore, all information in the website is, unless otherwise specifically stated, intended for informational and/or marketing purposes only and should not be construed as:

Luminor shall not be responsible for any loss arising from any investment and/or arising from using or interpreting the information provided herein.