Financial markets update: March 2018 | Luminor

- February was the first down month for global stocks after a 15-month streak of gains

- Forced liquidation in some volatility trading products reinforced the selloff

- Although the price correction was quite extensive, the market quickly rebounded and the All Country World index finished February with a loss of 2.3 %

- New Federal Reserve president Powell spooked investors with a suggestion for more rate hikes than expected

- Historically, the current stage of the tightening cycle was followed by positive average returns in both 1 and 3 year perspectives

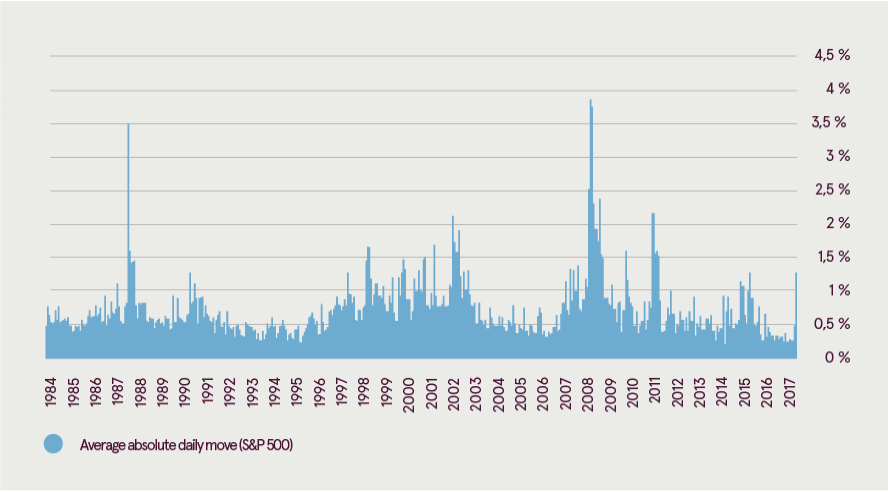

- The average absolute daily move in the S&P 500 spiked to 1.3 % compared to a very benign 0.3 % during the last 1.5 years, but stayed far from crisis levels.

- Higher rates in the US may provide support to the USD in the near term

- Expanding global economy and expected double digit earnings growth still support a further upside in stocks

February – the first down month for stocks after 15 straight months of growth

February has put an end to a long streak of almost straight moves up in global equity prices. Up until February, the US market closed positively for 15 months in a row, which happened only once before. The steady growth and extraordinarily low volatility led to too much complacency among investors and raised short term sentiment to positive levels not seen for more than two years. Such conditions almost always lead to short term price corrections, thought the exact timing of the correction is hard to predict in advance as it usually requires some catalyst.

The trigger this time was the suddenly increasing fear of higher inflation and faster than expected monetary policy tightening. High investor sentiment and general complacency reinforced the move’s downside, as investors got caught unprepared. Additional fuel to the fire was added by the forced liquidation of short volatility trades. For the past couple of years investors have been piling into financial instruments betting on declining volatility. The trade provided steady profits during that period, luring in more investors who, however, largely underestimated the risk of blow-up. As a result, poor understanding of the instruments used and miscalculations led to massive losses for short volatility trade, as the markets went down and volatility spiked. Some of the funds utilizing that trade were essentially wiped out and had to close, in what was an outstanding example of the importance of knowing the risks and the instruments you use.

Correction was followed by a quick rebound and 1-year performance remains positive

As a result of the abovementioned circumstances the selloff was quick and pretty extensive. The All Country World index fell 7.9 % from top to bottom, while Emerging market equities dropped over 9 %. However, the markets also rebounded quickly, as investors took advantage of lower prices to add to their positions. This is a good indication that the selloff was purely technical in nature and that market fundamentals remain positive. Both emerging and developed market equities finished February with slightly over 2 % decline. Looking at the year to date performance, the selloff pushed the All Country World index into negative territory (-0.6 %). The 1-year performance still remains positive for both developed and emerging markets, with the latter being up 11.2 %.

Should investors fear higher interest rates?

The reassessment of the expected interest rate path ignited the current correction. Investors fear of the faster rate hikes was reinforced by new Federal Reserve Chairman Jerome Powell. During his first testimony before Congress he indicated that the Fed expects to hike rates three or even more times this year to prevent the economy from overheating. Although he later tried to tone down his message to not sound so aggressive, the damage was already done. But should investors actually fear higher rates at the current stage?

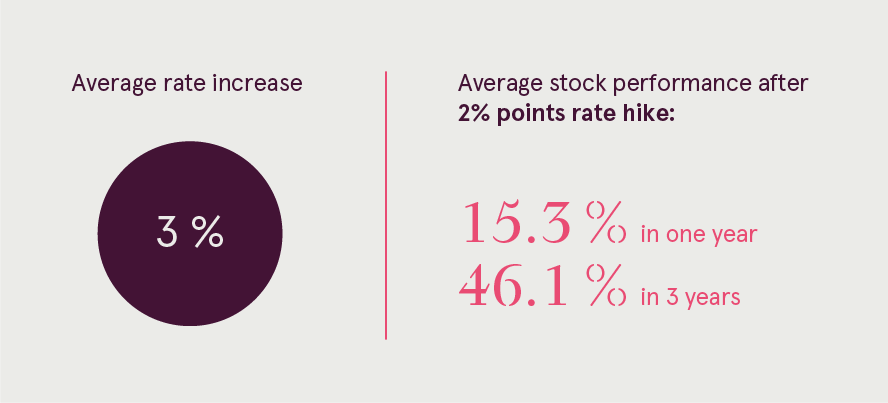

Looking at the past interest rate cycles, the average interest rate increase during a tightening cycle was 3 % points. For now, the increase has been only 1.25 % points. Moreover, the current interest level is still very low itself. If we assume three additional rate hikes this year to a total increase of 2 % points, then historically that was followed by a positive 1 and 3-year performance for stocks in all but one case. Moreover, the average gain for the S&P was 15.3 % and 46.1 % for 1 and 3 years, respectively.

Finally, the overall very low level interest rate provides additional support, as according to J.P. Morgan, only rates over 4 % have historically been a drag for stocks.

Volatility is higher but far from extreme

After a long period of calm and a steady rise, the current bout of price fluctuations may seem extreme. In reality however, it Is very far from the levels seen during a crisis.

For the month of February the average absolute daily movement in the S&P 500 (taking both up and down movements) was 1.3 %. This is indeed a steep increase from the levels experienced during the last 1.5 years, which was just 0.3 %. However, looking at the longer perspective, the current range is nothing extraordinary, as we have experienced the same fluctuations, for example in January 2016. The highest levels of daily fluctuations during the current up-trend were seen during the 2011 correction, when the average absolute daily movement reached 2.2 %. However, to put it in perspective, the average daily move at the height of the latest financial crisis was almost two times as large, at 3.9 %.

Therefore, although investors should be prepared for the higher volatility to stay, it is perfectly normal for later stage bull markets. Moreover, such fluctuations provide good opportunities for investors wishing to add to their positions or those who invest regularly.

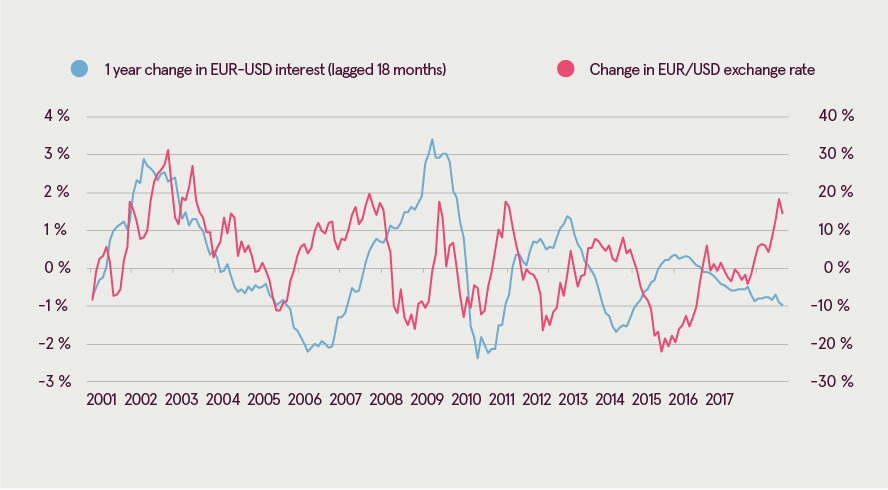

Higher rates in the US may provide support to the USD

The expectations of higher rates in the US have also influenced the EUR/USD exchange rate. The widening interest rate differential between the US and Eurozone should make the USD more attractive. Although historically the correlation was not too high, at the current stage that may provide support to the USD. Therefore, in the near term perspective we may see a move higher in the USD.

In the longer-term perspective, however, economic factors still support a weaker dollar going forward.

Fundamentals still support further upside in stocks

In the longer perspective, despite the current correction nothing has changed and the outlook still remains positive. The main factors are still supporting the upside for global equities, as the economy expands in all major regions, earnings are expected show double digit growth, interest rates are still fairly low and the overall global monetary policy is still very loose. Therefore, we view the current reaction as temporary and expect that the uptrend should continue. Nevertheless, volatility will most probably increase going forward, as is usually the case in the later stages of an up-trend.