Luminor pension plans are on their way to recovery | Luminor

Tarass Buka, CFA, Luminor Asset Management IPAS Fund manager

Looking back at 2020, we can now conclude that Luminor pension plans have successfully overcome one of the most dramatic and unusual periods in the recent history of the financial markets.

At the beginning of the year, the main question was whether the coronavirus in China could be considered the black swan of the global economy and financial markets. If the virus had not spread to other countries, the situation probably would not have had such an impact on the markets.

Through the last decade of February, global stock prices continued to rise and reached an all‑time high level. Already at the beginning of March, financial markets experienced an unprecedented fall, having suffered one of the historically sharpest price fluctuations. Several price change records were observed with stocks entering the bear market.

The recovery of the financial markets was rapid. Most of the financial assets in Q2 and Q3 showed positive dynamics, which were mainly based on a constant inflow of stimulus provided by central banks and governments of the world’s countries, as well as success in combating the virus, which allowed the developed countries to begin economic recovery.

The rise was not uniform. During Q3, the US stocks almost recovered all losses, and at the end of September the year‑to‑date result of S&P 500 index was only -0.3% (expressed in euro). In turn, the performance of the European stock index STOXX 600 since the beginning of the year is still negative (-13.2%).

Further recovery largely depends on the spread of the virus. Unfortunately, in autumn it reached the same or even sharper indicators than in spring, thus affecting the pace of the economic recovery and the results of companies.

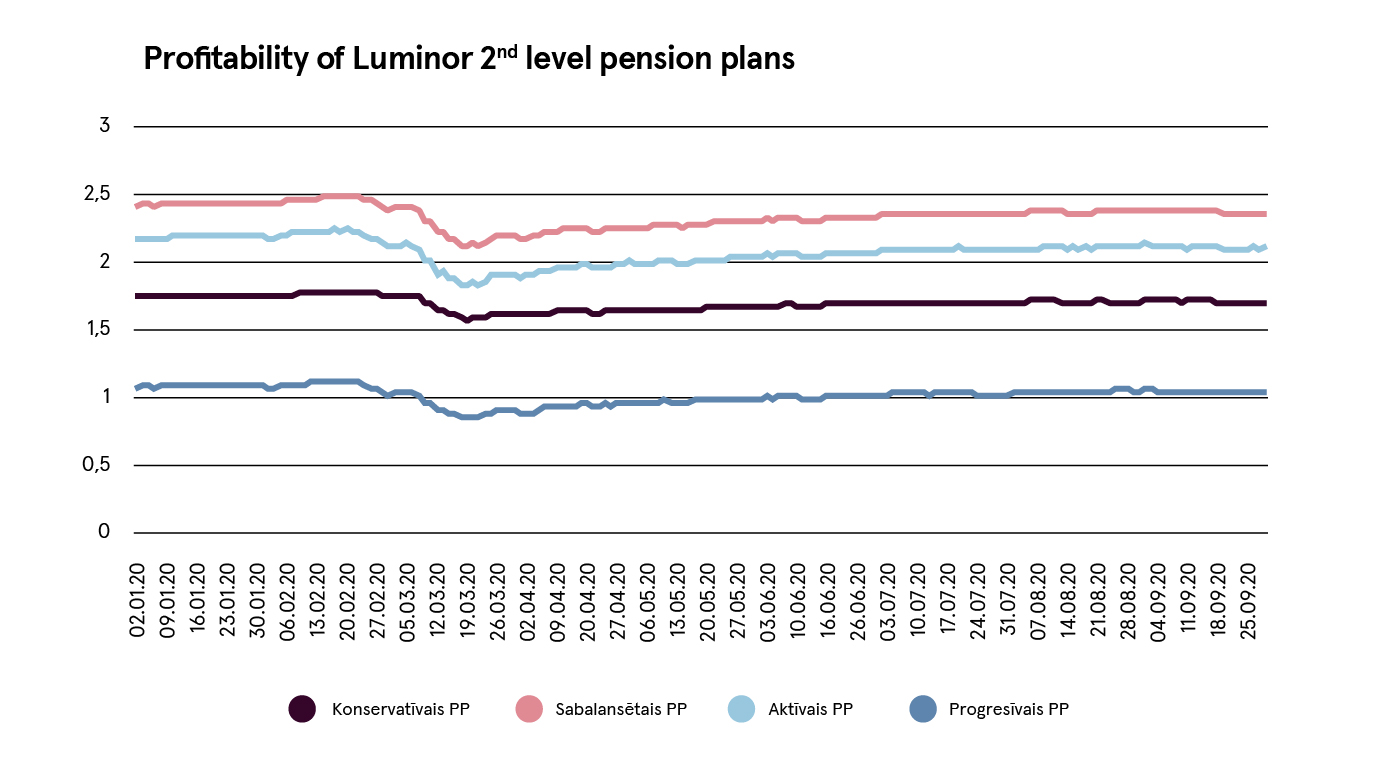

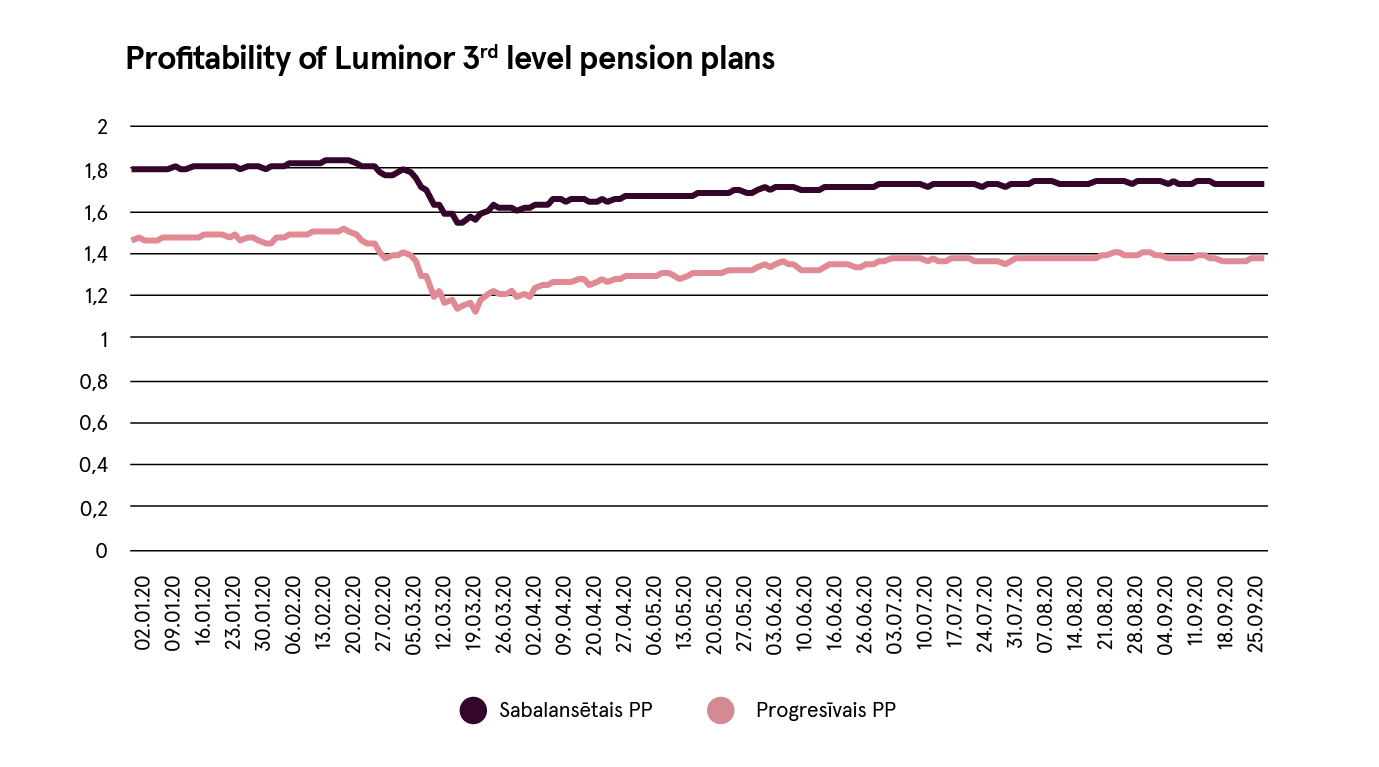

Despite a volatile beginning of the year, Luminor pension plans showed growth in spring and summer, when pension plans with the largest share of stocks did the best. If we look at the results since the beginning of 2020, the pension plans with lower share of stocks fared better due to lower risk level. The charts below show the performance of of the pension 2nd and the 3rd pillar plans*.

Luminor pension plans follow active fund management principles. In spring, we limited the risk by reducing the weight of risky assets in the plans – riskier bonds and stocks, while increasing the weight of government bonds. In stock plans, we primarily reduced investments in the most affected markets, e. g., Europe and the USA. Such changes helped to reduce the impact of the increased volatility on the financial markets.

After the introduction of stimulus programs and seeing that the economy starts to recover, the strategy was revised. First by increasing the proportion of riskier bonds, and then the proportion of stocks in portfolios.

An important step for Luminor pension plans in Q3 was the investment of 7 million euro in the alternative investment fund Altum. Altum kapitāla fonds plans to invest in large Latvian companies to help them overcome the negative impact of the virus. For the companies, this is a unique opportunity to obtain financing from the local capital market, and for pension plans – to earn together with Latvian companies and contribute to the development of the economy.

Currently, financial markets remain volatile, and the risk that the short‑term situation and sentiment could change in any direction remains high. We follow the developments and are ready to make changes in the pension plan investments, based on the thought‑out decisions for the purpose of ensuring long‑term growth of pension capital.

*Luminor 3rd level pension plans are administered by AS Luminor Latvijas Atklatais Pensiju Fonds, reg. No. 40103331798, Skanstes iela 12, Riga, LV‑1013, and managed by IPAS Luminor Asset Management, reg. No. 40003699053, Skanstes iela 12, Riga, LV‑1013. The funds holding bank is the AS Luminor Bank Latvian branch, reg. No. 40203154352. Luminor 2nd level pension plans are managed by IPAS Luminor Asset Management.

Information in this article cannot be considered an investment recommendation or an offer of a product or service. Investments in securities contain several risks, including the complete loss of the invested amount. The value of investments in pension funds can both rise and fall over time. Historical profitability does not guarantee equivalent profitability in future.

For more information about Luminor pension products please visit our website: luminor.lv/en/pensions