Luminor prognosis: Economy slows before acceleration | Luminor

Pēteris Strautiņš, Luminor economist

Peteris Strautiņš, Luminor economist

Main highlights

- Economy slowed abruptly in the first half of the year. GDP growth rate almost halved to 2.6% from 4.8% in 2018. We expect Latvia to grow by 2.6% in 2019. Next year growth might slip to just below 2%, but in 2021 and following years strong recovery is on the cards.

- The disappointment was caused by growth slowdowns and declines in sectors where some weakening was expected — forestry and timber, construction, transit, but these were sharper than expected. Value added also declined in finance, due to policy change as well as in energy, caused by natural conditions.

- Growth pick-up in the following years will be mostly determined by local and industry-specific factors — RailBaltica construction, rapid change of exports structure, housing cycle. Global growth might accelerate from 2020, but there is high uncertainty about that, especially in the euro area, due to the shortage of effective macro policy tools.

- While there are have been significant disappointments, most businesses and individuals are likely to sail unscathed through what is likely to be a mild downturn in the business cycle.

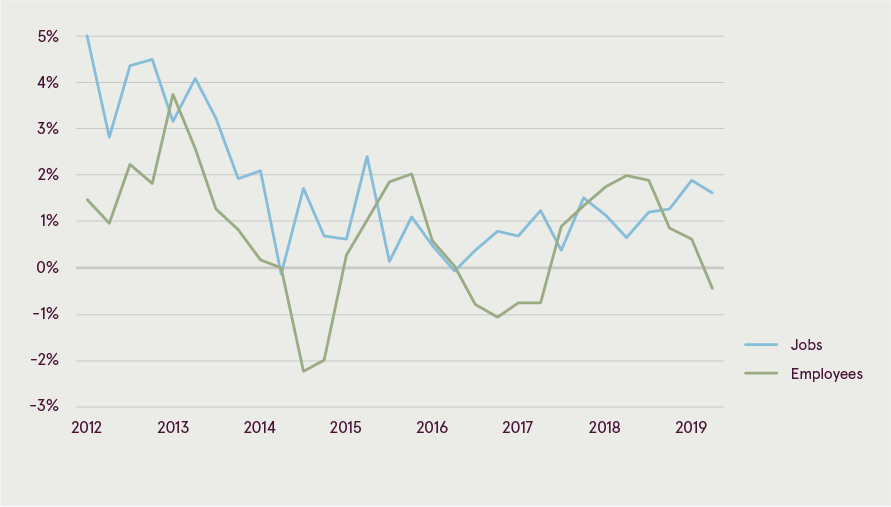

- Labour market remains strong and there will be little relief for many hard-pressed employers. The decline of unemployment will only slow down before resuming later. Wage growth will continue, though at a more moderate pace. Job and wage growth have turned around external migration in Estonia and Lithuania, Latvia will follow.

- Regional developments will be quite uneven. Riga’s economy will be boosted by booming white collar service exports and incipient housing cycle, but regional economies will be affected by the very uneven performance of goods producing sectors and volatile transit business.

- Country is moving forward in important public policy areas. Planning of regional reform is advanced and it has a chance to pass political hurdles. School curriculums are undergoing profound changes. There has been lack of progress in higher education, however. Tax reform might have improved incentives to invest, but results remain to be seen.

Economy in general

Growth has been quite volatile in Latvia over the last five years and it is likely to be uneven also during the next five. We can reasonably expect at least a couple of outstanding years during this period, but the next one could be disappointing.

GDP growth reached almost 5% in 2018, also this year still apparently started quite well, lower annual GDP growth (+3.0%) in Q1 was caused by obvious one-offs in energy (the effect of drought on hydro power) and real estate (mostly high baseline effect), without these annual GDP would have been ~4.5%. Manufacturing and service exports still performed very well. Q2 brought significant negative surprises, mostly faster than expected downturns in sectors with strong recent performance — timber, transit, construction. Annual GDP growth slipped further to 2.0%. Seasonally adjusted annual growth was 3.2% and 2.9% respectively.

While the global slowdown is happening in the background, the adverse developments in Latvia have occurred mostly due to local and industry-specific events. These will continue to exert influence later in 2019 and in early 2020, besides also the effects of worsening global trade conflicts and Brexit are bound to arrive. So we expect growth in Latvia to slow further next year. There is a plenty of reasons to expect growth acceleration in 2021-2023. RailBaltica construction will swing into action. Growth impetus from the dynamic intellectual service exports will increase with their growing size. Manufacturing is likely to benefit from capacity expansions in both timber processing and metals&machinery. Housing market and household lending recovery will gather strength.

The effect of growth fluctuations will differ across the country. Greater Riga that increasingly relies on booming white collar service exports, currently advantageous specialisation in manufacturing (machinery, electronics, pharmaceuticals) and is supported by the gradual pick-up of housing construction is the best positioned. Areas with a high share of timber sector (Vidzeme) and heavy reliance on railway and port employment (Daugavpils and Ventspils) are more exposed to risks.

Predicting global economic developments is never easy, but now the situation is unprecedented, never before has trade policy of world’s most important country been so volatile. However, there is little doubt about what needs to be done to accelerate progress in Latvia, more about that in public policy issues section.

External conditions

Outlook for the global economy is much less favourable than during our previous report when there was an apparent stabilisation after the downturn in late 2018. While the growth has slowed in the USA, situation there is still quite favourable. Also the slowdown in China is gradual. Situation is more precarious in the euro area where the indicators for manufacturing are very unfavourable. Consumer confidence and consumption have remained quite robust so far, helping to sustain a very modest expansion. In the past the rest of the economy has usually followed manufacturing. We do not assume euro area recession in our baseline scenario, but risks are significant.

Compared to Lithuania and Estonia, Latvia has stronger intra-Baltic trade ties that is an obvious positive now. For several years Baltic states as a whole have benefited from favourable conditions in the neighbourhood — Nordics and Poland. That is still mostly the case, but the picture is less uniform as Swedish economy has slowed sharply, notably housing construction that draws in a lot of imports from Latvia is in a recession. Brexit is an obvious and often mentioned negative and a source of uncertainty, due to the chaotic state of British politics.

We assume that 2019 is the lowest point in the global cycle, a modest recovery will follow in 2020-2021. There is one longer term risk that is not the baseline scenario, but nevertheless can occur — euro area might slip into prolonged stagnation. It is obviously in a liquidity trap already, central bank is becoming powerless to affect the direction of the economy.

Exports

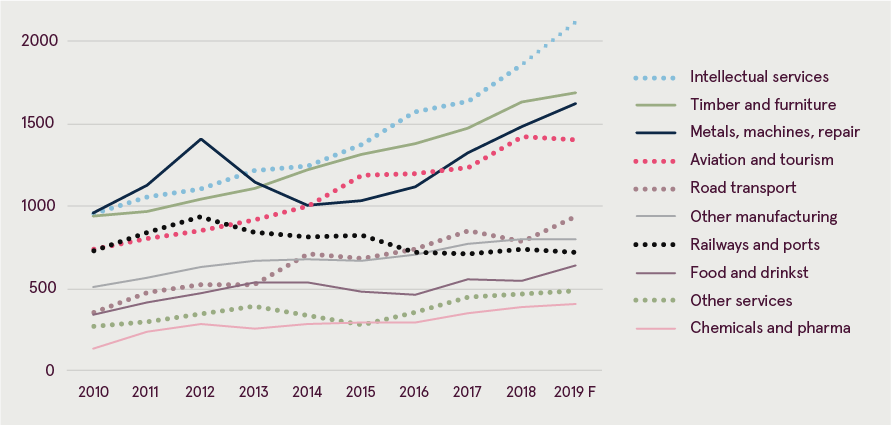

Real export growth in H1, 2019 accelerated to 3.2% in annual terms from 1.8% in 2018. However, due to the fluctuations of re-exports, the performance of the main exporting sectors is more important, it is much more mixed now than it was last year.

The most notable change has occurred in the timber industry, its cooling after the fantastic 2018 was expected, however, the pace of events in Q2 was a surprise even to the best-informed players. Some commodity timber prices are down by 15-20% from the peak. The effect of timber price decline is yet to be felt in full, but the worst should be over in 2020 unless the global economy worsens much further. These difficulties are temporary, in the long run value added will grow.

East-west transit of goods along the railway-port axis is now falling in annual terms after growing in 2018 and early 2019, but the volume is still within the range of typical past fluctuations. The volume of cargos has been broadly stable during the last few years in Ventspils and Liepāja ports, but the trend is downward sloping in Riga. Transit has avoided the worst scenarios, but neither is it likely to contribute much to the growth in the future.

Maintaining the current volume is probably the best that can be hoped for. Energy production in Europe is shifting away from coal and Russia continues to develop its own transit routes.

On the other hand, things are going well in sectors that will be the main export growth drivers in the future. Revenues from intellectual services (business, IT, telecoms, finance) grew by 13.5% in H1. Metal processing and machinery has expanded steadily, especially electrical equipment production that grew by 25.1% in January-July. Significant investment projects are being implemented — new factories and capacity extensions, most of them by Nordic, German, French and other old EU companies, but also some locally established and owned businesses are asserting themselves. These sectors are steadily increasing their share in Latvian exports.

Production of capital goods and automobiles is falling in Europe, so one could expect reflection of that in Latvian manufacturing data, but this is obviously not the case. Global manufacturing groups with many production locations are likely to reduce volumes in the high cost countries first. The sector has done a good job in diversifying export markets. Significant recent capacity extensions along with greater diversity of products can also compensate the effect of weaker demand.

Annual service exports and manufacturing turnover in exports, millions of euros

Source: Statistics Latvia, Bank of Latvia data, Luminor forecasts

Note: The annual growth rate in H1, 2019 is assumed to continue in H2, 2019. “Other manufacturing” includes production of paper and printing, plastics and rubber, minerals. The biggest item in other services is construction.

The rising role of these services and goods is important news for the long-term potential growth rate. While there are persistent worries that labour pool is drying up, these sectors have powered ahead. Here one can observe a struggle between the effects of decreasing and increasing returns on scale. Decreasing returns come from employing people that at least initially are less qualified. Increasing returns come from cluster effects — interactions between increasing quantity and quality of knowledge, makers of increasingly diverse technological products.

Consumption and investment

The macro environment for consumption growth is favourable. However, at the time of writing retail, the biggest consumption sector has experienced three months of very weak annual growth (1.2-2.1%), and this is becoming worrying. The mirror image of consumption weakness is very rapid growth of household deposits that strengthens family finances and provides resources for lending growth. However, at the moment the economy would benefit from slightly stronger consumer activity to pull it through the period of external weakness.

Growth of household loan portfolio is slowly gathering pace after the first positive number in a decade last December. Latvia still lags far behind other Baltics in this respect, this has been an under-utilised opportunity so far, but keeps open the possibility of growth spurt in the future.

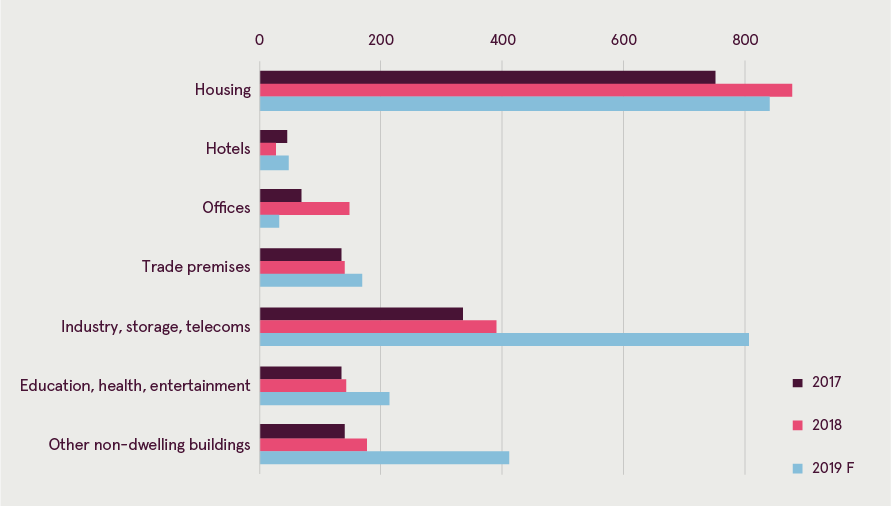

The slowdown in construction growth was quite abrupt, it almost ground to a halt in Q2, increasing just by 1%. Some of it came from smaller public sector spending on engineering works, as was expected. The slowdown was apparently exacerbated by late year 2019 budget adoption and postponement of related municipal building projects. Apart from this short-term issue, outlook for construction now is quite favourable. EU fund flows from 2019 to 2022 are expected to be smooth, RailBaltica is looming on the horizon. Construction companies are already allocating capacities, the peak volume will probably be achieved sometimes in 2023 or 2024. This is an enormous project with the biggest effect in Latvia among the Baltics.

Amount of issued building permits

Growth rate in H1, 2019 is applied for the whole year.

Source: Statistics Latvia data, Luminor forecasts

Note: The annual growth rate in H1, 2019 is assumed to continue in H2, 2019

The issuance of building permits grew by 28% in H1, 2019 picking up from 18% and 9% growth in 2018 and 2017 respectively. Details point to a coming boom of industrial construction that is an encouraging sign for the economy as a whole. Tax reform has cost a lot to the Treasury in 2018-2019, there has been virtually no corporate tax revenue for a year. However, putting so much money in the hands of enterprises while discouraging the outflow of dividends is likely to boost investment.

Labour market and prices

While forecasted economic developments typically differ from outcomes at least somewhat, Luminor economists got one major thing right in their recent writings by pointing out that economic growth will spur changes in demographic trends in the Baltics. It is now clear that more people will come to Lithuania this year than leave, it remains to be seen what will happen in Latvia. With the number of jobs and wages growing, positive migration balance is only a question of time.

Annual change of the number of occupied job positions (enterprise survey) and employment (labour force survey)

Note: The annual growth rate of jobs in Q2, 2019 is based not on enterprise survey, but State Revenue Service data

Many companies encounter genuine difficulties in finding qualified workers at wages they can afford. Some will inevitably shrink or close because of labour market conditions. This suggests lessening of immigration restrictions. One has to take into the account however, that many business are competitive at wage rates that make Latvia uncompetitive as a place of residence. This is not a critique of these enterprises, but points at an important policy dilemma.

There is a tough discussion about the need to import more high skilled or low skilled workers or both. First and foremost, the country will need more people to maintain the critical mass of population size, diversity of knowledge, demand for local goods and services, social and cultural activity. Economy needs a high proportion of young people to drive entrepreneurial activity. The distinction between high and low qualification can be much less clear than in statistics.

There is no doubt that the country would benefit from greater labour mobility. The number of occupied job positions and self-employed was 94 per 100 inhabitants in 15-64 year olds in Greater Riga in 2017, the ratio was just 55/100 in Latgale. It is not quite true that “there is no unemployment in Latvia”. Remoteness in combination with relatively low offered wages discourage people to take up job offers.

Core inflation has gradually increased since 2016 when cost pressures were cooled by the aftermath of Russian economic crisis and sanctions. Modest increase of oil prices and tax changes pushed headline inflation above 3% in 2019, but it is likely to fall to ca. 2% in 2020. Oil prices have declined since April and are likely to fall further next year. The entry of new and ambitious food retailer will affect food prices, these are obviously lower in Lithuania were competition is more intense. In the following years inflation will gradually pick up as labour market pressures intensify.

Public policy issues

Typical barrier for countries that want to move from medium to high income is difficulty in switching from raw materials and manufactures to high end services as export driver. This appears not to be a problem for Latvia. Businesses seem to be coping with the quality of graduates supplied by country’s higher education, unemployment among them is very low. The fact that three large institutions are in global Top 1000 mean that high share of students get at least decent education. However, the country needs at least one university that is excellent, a member of Top500 club to retain the best talent.

To achieve this, Latvia should stop trying to live both in the past and the future. Resources that could have been devoted to financing globally competitive higher education and science are still being spent on unsustainable school network. Institutional changes in higher education have lagged behind the very substantial investment in facilities, let’s hope that the current messy conflict about the University of Latvia leadership will ultimately lead to better governance in this crucial area. Besides disciplining institutions Latvia also needs to discipline beneficiaries of public services. Business community has long asked to make physics exam mandatory.

Tax reform introduced in 2018 has ameliorated incentives to invest. There are tentative signs of results in construction permit data. The planning for the next tax reform will start in 2020, its main goal will probably be addressing the public sector financing challenges that seem in surmountable if ratio of tax revenues to GDP remains so far below EU average, at 30% of GDP.