What you should consider when contacting the bank remotely

If you have called the bank’s official telephone number (the conversation is recorded) we may ask for the following information for the authentication purposes:

SMS are sent in situations as follows:

As so many people worldwide are using e-mail it has become one of the principal targets of cyber criminals.

E-mail messages, which are ostensibly sent on behalf of the bank, often are used for quite a different purpose - to obtain the information about the bank’s customer (user’s ID data, passwords, code cards) for its further malicious abuse. Most frequently such e-mail messages represent the following:

When using WhatsApp you should never disclose the information as follows:

When using Facebook you should never disclose the information as follows:

To avoid a situation where your internet-bank and payment data falls into the hands of ill-wishers:

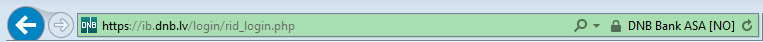

If you are using Internet Explorer browser you will find the key on the right side of the address bar

If you are using Mozilla Firefox browser, the key will be placed on the left side of the address bar

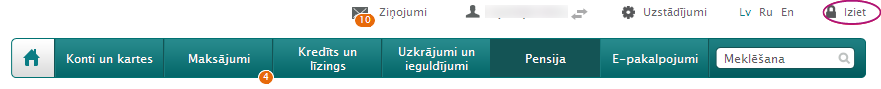

Always after using your internet-bank click “Exit” in the upper right corner.

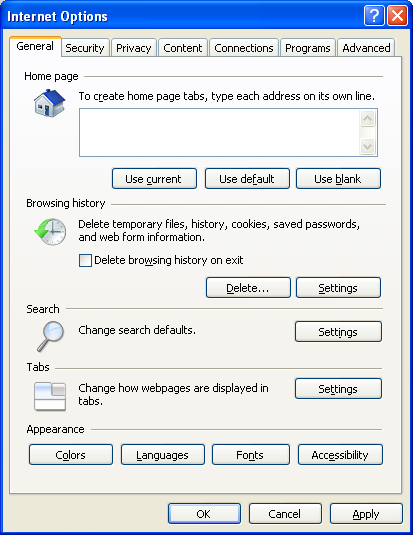

To enhance the security we recommend:

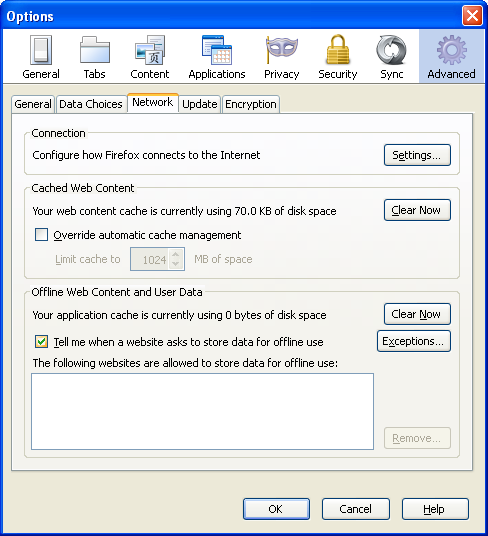

In Mozilla Firefox browser: Tools – Options – Advanced – Network – Cached Web Content – Clear now

In Google Chrome browser: Settings – History – Clear browsing data

Login name

Login is your username to enter your internet-bank. It consists of figures, remains unchanged during the entire period you are using the internet-bank and must be entered every time you are using your internet-bank.

Login password

When using internet-bank, after entering your login name you also use your login password (if you have a code card or Digipas GO 3 code calculator). Users of code cards and GO 3 code calculators will be asked to enter their login password to replace the internet-bank password.

Code card

Code card represents a plastic card with 36 reusable codes to enter your internet-bank, approve payment orders, change passwords or conduct other internet-bank transactions. Every time when a code will be required your internet-bank shall indicate the sequence number of code from the code card. Do not use the code card to jot down your passwords or login!

As from 01.04.2017 all code card holders have additional security solution, i.e. SMS code. SMS code is a 5-digit combination, which is free of charge sent to the code card holder’s mobile telephone to:

Code calculator

Code calculator is a special security device that enables the user’s identification in internet-bank and approval of transactions conducted therein. The code represents an eight-digit combination generated by the calculator. Every code is unique, valid for a short period only and is one-off.

Time limitations on the use of internet-bank

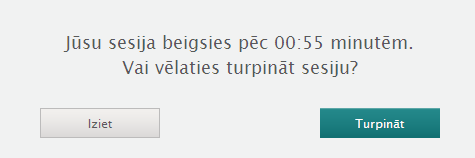

There is a time limitation on the internet-bank log-in sessions. The principal reason for imposing the time limitations is to protect you in case you forget to switch off your internet-bank when leaving your computer. If there is no activity in internet-bank for 15 minutes, is activated the 2-minute countdown by asking you, whether you want to continue or turn down your session. If within 2 minutes none of the options is chosen the session is terminated and you are asked to log in once more.

Blocking of users

Internet-bank access is blocked in instances as follows:

1. If upon the log-in process the user five times in succession enters wrong login name, login password or code from the code card/ code calculator;

2. If for five consecutive times is wrongly approved the payment - entered wrong code from the code card / code calculator.

To avoid unauthorised access of any third parties to your internet-bank account:

Protection software (firewall)

It is important to equip your computer with a firewall to secure protection of your information and your computer in internet. Firewall is a program, which by data filtration regulates the flow of information between your computer and internet and eliminates any unauthorised access to your computer.

Antivirus programs

Antivirus software checks the information against viruses, identifies, puts in quarantine and destroys identified viruses. In order to achieve maximum efficiency your antivirus programs must be updated on regular basis.

Not always antivirus and firewall programs are able to protect your computer against external attempts to acquire the information. Therefore it is recommended to check whether your computer is free from any spy or keystroke recording software, whose sole purpose is the acquisition of information. Use the spy software detectors to detect any spy and keystroke recording software than might be installed on your computer.

Fraudulent e-mail messages

Often enough an e-mail message that is ostensibly sent on behalf of the bank are used for a single purpose - extract the information on the bank’s customer (user’s identification data, passwords, code cards) to abuse this information at some later stage. Most regular types of such e-mail messages are as follows:

To use the DNB internet-bank you need one of the means of identification: code card, Digipass Go3 calculator or Digipass 270 calculator. Please, find below the essential information about every single security element used by the DNB internet-bank.

Code card

Description: Plastic card with 36 codes.

Code: 36 reusable codes, each one consisting of 7 digits. The system requests their entering in a random sequence.

Change of the Internet-bank password: You have to call us to 1880 (+371 6717 1880) or visit any branch of the bank DNB.

Security: 36 codes, selected by the system at random, which repeat themselves.

Logging in: Login name (number) + password + code from the code card.

Approval of payments: Must be entered a code from the code card as requested by the system + SMS code (on amounts above EUR 30 or approval of different orders)

Summary: Medium security level, low cost, suitable for everyday use.

Digipass Go3 code calculator

Description: Security tool, which after pressing the button generates an 8-digit code.

Code: Random 8-digit combination, which does not repeat.

Change of the Internet-bank password: By receiving a password through text.

Security: Unique code, not reusable.

Logging in: Login name (number) + password + code from the calculator.

Approval of payments: Must be entered a code from the code calculator.

Summary: High security level, medium costs, simple use, suitable for private individuals and small enterprises.

Digipass 270 code calculator

Security tool, which after entering the PIN code and pressing the button generates 8-digit codes.

Code: Random 8-digit combination, which does not repeat.

Change of the Internet-bank password: No password! There is a PIN code, which can be changed by the user.

Security: Unique, one-off code + PIN code protection.

Logging in: PIN + login name (number) + code from the calculator.

Approval of payments: Internet-bank generates the code to be entered in the calculator; afterwards the calculator displays a response code to be entered in internet-bank.

Summary: Very high security level, higher costs, more sophisticated use, suitable for bigger payments.

What to do if you have lost your security element - please, refer to the section “Lost ID tool”!

To see the price for every identification tool, visit the DNB website under "List of Conditions"!

* - Functions of Digipass 260 code calculator are identical to those of DP 270 code calculator.

To prevent unauthorised access to your data by any third parties when using Quick access in your Mobile bank:

Password is something we use practically daily, starting from e-mail or internet-bank access including the use of smartphones or online stores. That said password can also become your weak spot. If somebody finds out or guesses your password, they can get access to your accounts like yourself, and transfer your money, read your e-mails or steal your identity. This is why secure passwords are material for your protection. However, passwords may be hard to memorise and difficult to enter. Below you will find some information about generation of secure passwords, which are easy to memorise and simple to enter - they are called passphrases.