In what ways investing in securities is better than bank deposits or real estate?

Bank deposits, real estate and securities are the most popular investment classes among Baltic households.

According to Eurostat, the most popular choice among households in Latvia are term deposits that yield only up to 0.15% in the three largest banks of the Baltic States. Even though it is the safest investment among all mentioned above, it is important to note, that the average inflation in Latvia is 1.5%1, so, at the end of the day, people are paying money for the banks to safekeep their money.

The next investment type that is loved by Latvian households is real estate which yields up to 4-6% annually2. Although buying and renting out a property is often considered as an alternative investment, for many people it is the simplest way to invest that associates with safety and stable income. However, real estate involves significant risks as well. For example, during 2008 financial crisis, real estate prices fell by more than 30%3. It indicates low liquidity of the physical assets - in the times economic downturn, selling a house or an apartment without suffering a loss can be very difficult. Also, profitable real estate business requires considerable amount of initial capital and knowledge about administration, maintenance, repairs.

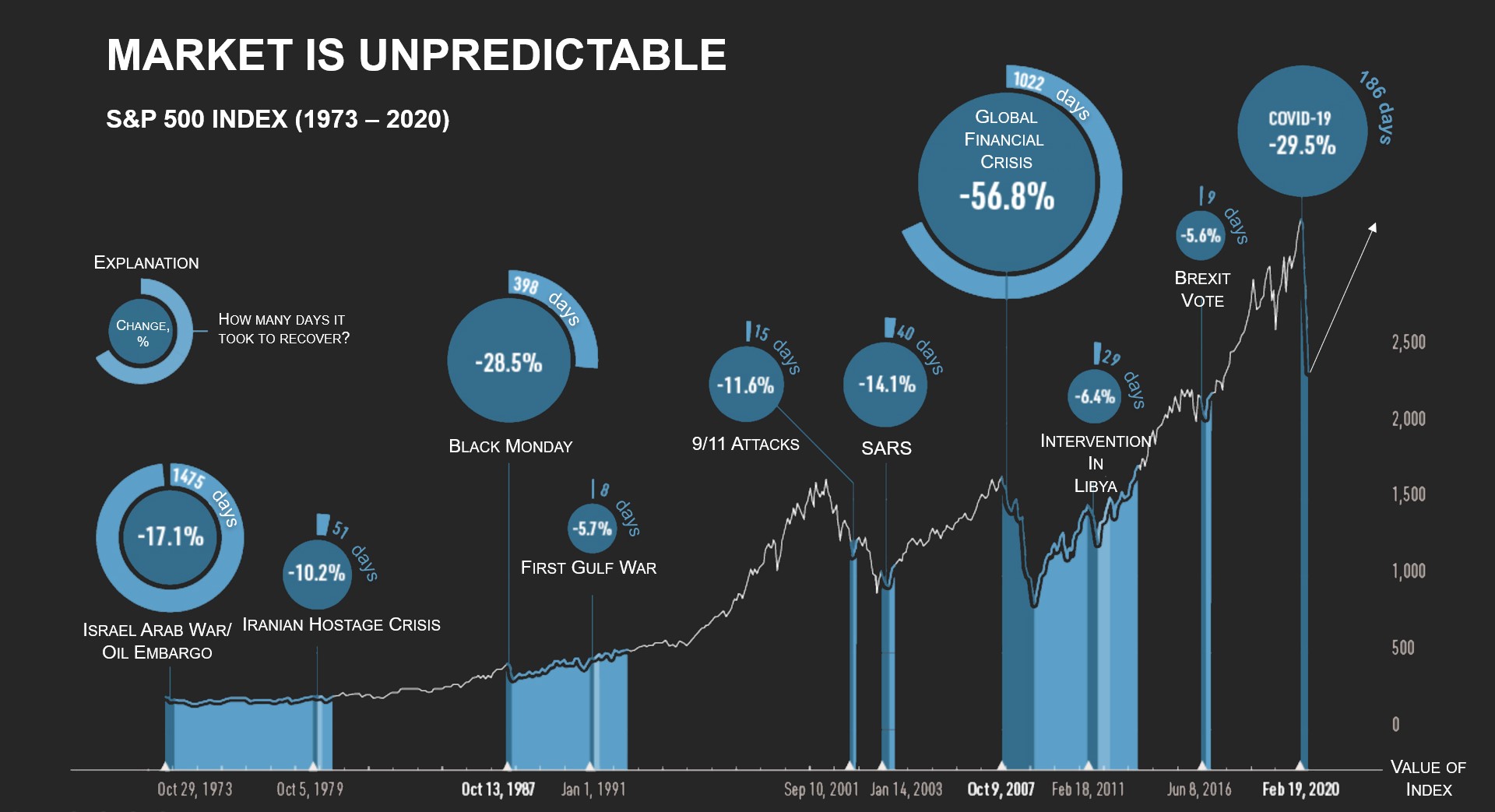

More than 100 years of research has proven that despite all crashes of the economy, buying securities for the long period is the greatest wealth making machine in history4. No other type of asset class could match average rate of return in the stock market. For example, if in 1970 you had invested $10,000 in S&P 500 index (indicator that tracks performance of 500 biggest companies in the U.S.), today you could cash out your investment for around $400,000. Unlike starting your own business or investing in real estate, buying securities does not require constant supervision or large initial investment. Also, even in case of economic slowdown, it is the most liquid investment instrument – under normal trading conditions, the positions can be sold within the same day.

What is important to know before starting to invest in securities? How to choose the best instrument?

Historical results show that stock market is rising in the long run. For example, over the last 50 years, the return of the aforementioned S&P 500 index has averaged at 10% per year.

After taking a closer look, it is seen that bear markets happen every 4-6 years on average, but usually they do not last. However, in case of market volatility, some investors may find themselves catching strong emotions and making impulsive decisions. They try to “catch market waves” what is more like a casino game rather than a rational strategy that goes in line with long-term financial goals. The paradox is that, according to a Fidelity’s study5, the best investors are dead or have forgotten that they have investments what only proves that it is not necessary to be a financial expert in order to profitably employ capital in the securities market. Thus, since nobody can consistently predict whether the market will rise or fall, the biggest danger is being out of the market.

When building a portfolio, it is critical to consider financial goals, risks tolerance and monetary constrains. Vanguard’s experiment has shown that asset allocation decision is responsible for 91.1% of success in investing, while security selection and market timing – only 8.9%6. This only proves that attempts to guess market direction or selection of “the best” instrument are not the factors that investors should be worried about.

What are investing tendencies in the Baltic states?

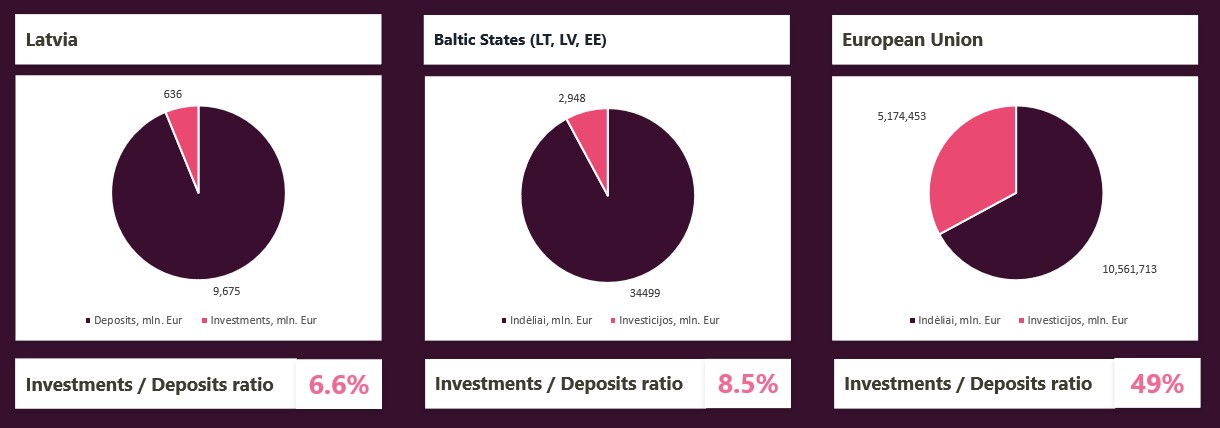

Baltic states households invest in securities 5 times less than the EU average. Such a huge difference can be due to a lagging mindset towards importance of investing, fear of losing money and a lack of knowledge.

„The main reason why so many Latvians have not started investing – they do not know where and how to start, - says Tomas Vaicekauskas Luminor’s Savings and Investment products development manager for Baltics. – In order to provide a simple access to financial markets for Luminor clients, last year Luminor Investor platform was launched. Not only it allows to purchase traditional stocks, bonds and mutual funds but also exchange traded funds (ETFs) that are usually designed to track the performance of the world’s biggest market indexes, such as S&P 500 or Dow Jones, what allows to diversify savings among hundreds of different companies with just one click“.

Disclaimer: Investing involves risks. The value of the investment during the investment period may increase or decrease, and the return is not guaranteed. In certain cases, the investor may lose the invested sum and loses may accumulate in excess of the initial investment. Luminor does not provide recommendations in Luminor Investor Platform. Luminor does not take into account any particular client’s investment objectives, special investment goals, financial situation, specific needs, demands, knowledge and experience. Therefore, all information in the website and this article is, unless otherwise specifically stated, intended for informational and/or marketing purposes only. Further information about Luminor Bank AB investment services, terms and conditions, price lists and the related risks can be found here: luminor.lv/en/information-investors.