What to do in case of an insured event?

Travel insurance:

- If you have an insurable accident abroad and need coverage for medical expenses, contact our travel assistance partner UAB OPS International by phone +371 6755 8899 or eclaims.eu;

- In case of a non-medical insured event, upon your return to Latvia, please fill in an application form online at eclaims.eu;

Purchase insurance:

- submit an application to Compensa Vienna Insurance Group online at compensa.lv or by phone 8888;

- submit a receipt or invoice confirming that the product was purchased with a Luminor Black card;

- attach photos of the damaged or stolen item.

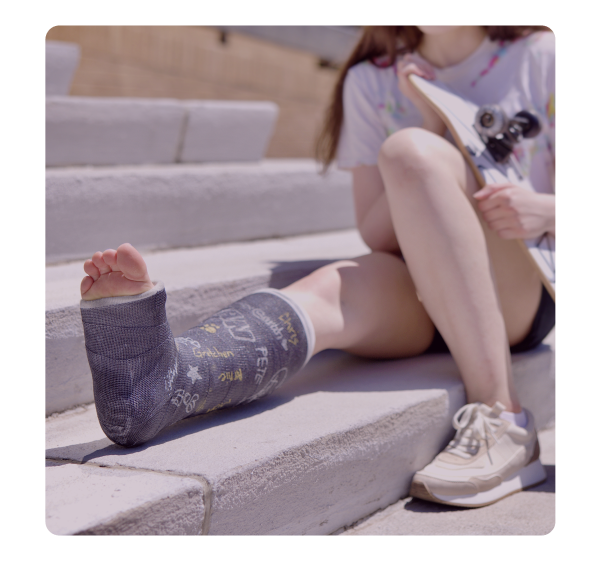

Broken and fractured bone insurance:

- submit an application to Compensa Vienna Insurance Group online at compensa.lv or by phone 8888;

- attach X-rays and/or CT scans, MRI scans to the application.