Walking the Tightrope

- Debt ceiling drama

- Mixed Messages from Central Banks

- German Economy Stumbles

Recently, the focus has been on the debt-ceiling, instability within the banking industry, and uncertainty regarding the Federal Reserve's (Fed) future actions. However, it is the economy that determines the trajectory of market movements. Beyond the short-term noise of the debt-ceiling headlines, markets will ultimately shift their attention towards evaluating the prospects for economic growth, inflation and Fed policy. These fundamental drivers of long-term investment performance do not suggest that the view ahead is clear. Despite that, during May the developed markets stocks’ index MSCI World (EUR) has risen by 2.52% and the emerging markets stocks’ index MSCI Emerging Markets (EUR) has added 1.81%.

Debt ceiling circus captures the market’s attention

The political drama around the debt ceiling and the frequent tense negotiations resulting from a 1917-dated law that essentially created the debt ceiling was originally intended to make Congressional leaders’ lives easier, not harder, never seems to end. The existing debt ceiling was hit on January 19, and since then the U.S. Treasury has initiated extraordinary measures to pay for the country’s bills. Those efforts were expected to have been exhausted by June 1. This so-called "x-date" is when the U.S. would need to raise or suspend the debt limit to avoid a default. While both parties agree that defaulting on debt is not an option, politicians appear tempted to use the process for their advantage. In the near term, we see little meaningful risk - rather, a market “noise” - which is part of investing and can result in market volatility until the end settlement is reached, for now.

Mixed messages about what's next for the Central banks

Some uncertainty surrounding prospects for a June rate hike has contributed to a rise in yields over the past month. Fed officials have shared mixed views on the need for further rate hikes. Recently, Minneapolis Fed President Neel Kashkari mentioned in an interview that a June hike is a “close call”, while other officials have adopted a milder tone focusing on the lagged effects of the prior hikes. Unless there is a major unexpected development in the upcoming inflation and employment data before the June meeting, indications suggest that the Federal Reserve is preparing to adopt a more cautious approach, as hinted in the May meeting. After a substantial rate increase from near-zero to slightly above 5%, monetary policy is now considered restrictive.

The European Central Bank (ECB) raised its key interest rates by 25 bps during its May meeting, signaling a slowing pace of policy tightening. All ECB policymakers but one, backed the 25-basis-point increase in the ECB's main deposit rate to 3.25%, which follows an unprecedented series of 75 and 50 basis point increases since last July. Meanwhile, President Lagarde told a news conference that the ECB had more ground to cover and it was not pausing the rate-lifting cycle, anytime soon.

Uncertainties Surrounding Germany's Economy

In the past, Germany has served as Europe's primary economic flagship, leading the region through various crises. However, this resilience is currently deteriorating, posing a significant risk to the entire continent. Output in Europe’s largest economy dropped 0.3% in the first three months of the year, following a 0.5% contraction at the end of 2022, official data showed.

German equities have been propelled higher by strong first-quarter earnings from such industrial powerhouses as Siemens AG, Bayerische Motoren Werke AG and Mercedes-Benz Group AG. But with manufacturing orders starting to weaken, there are question marks over the sustainability of those profits. The International Monetary Fund estimates Germany will be the worst-performing economy among the Group of Seven nations this year. If it stumbles further, it may drag the entire Euro zone into recession. Germany's DAX equity index is hovering near an all-time high, even though the country is technically in a recession, having posted two consecutive quarters of negative gross domestic product.

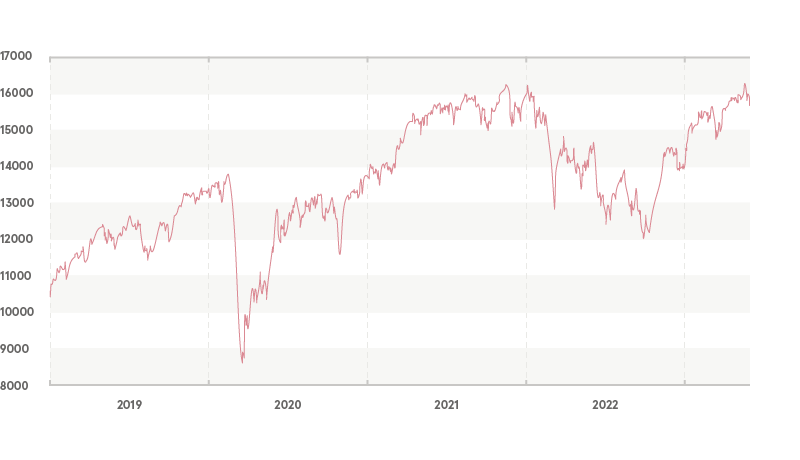

DAX German equity Index

Source: Bloomberg L.P.

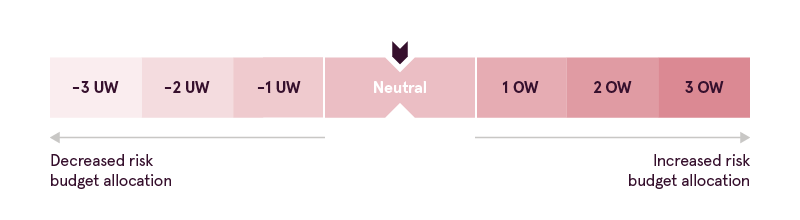

“House view” update

The investment team believes that the combination of positive and negative factors justifies maintaining a neutral risk allocation, resulting in the decision to keep the budget for neutral risk allocation unchanged.

Warnings

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from the Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, represented within the Republic of Latvia by Luminor Bank AS Latvian branch, reg. No 40203154352, address: Skanstes iela 12, LV-1013, Riga, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Latvian Financial Supervisory Authority (Finanšu un kapitāla tirgus komisija). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Latvia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question, and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument, a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to internal rules on sound ethical conduct, management of inside information, handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.